Table of Contents

Foreign Currency Valuation

Foreign Currency Valuation in SAP

FASB 52: is issued by US accounting standard board. It provides guidance on financial reporting of companies operating in foreign countries

- Functional Currency: Currency of the economic environment in which the entity operates. In case of SAP functional currency is generally company code / local currency of the entity (In this case company Code). All assets, liabilities and operations of foreign entity should be measured in functional currency

- Group Currency: This is the currency of the parent company.

- Foreign Currency transactions: These are transactions in a currency other than the functional currency of the company code

- Unrealized foreign currency gain/ loss: Receivables/ Payables in foreign currency have to be reported in-group currency at exchange rate on month end. Difference between group currency and company code currency exchange rate on transaction date and month end is posted as profit/ gain from foreign currency revaluation. This is than reversed at the beginning of the next month

- Realized Gain / Loss: These are gain or loss due to exchange rate difference when actual payment made to vendor or cash received from customers.

Now let’s configure and test foreign currency valuation in SAP

Foreign Currency configuration

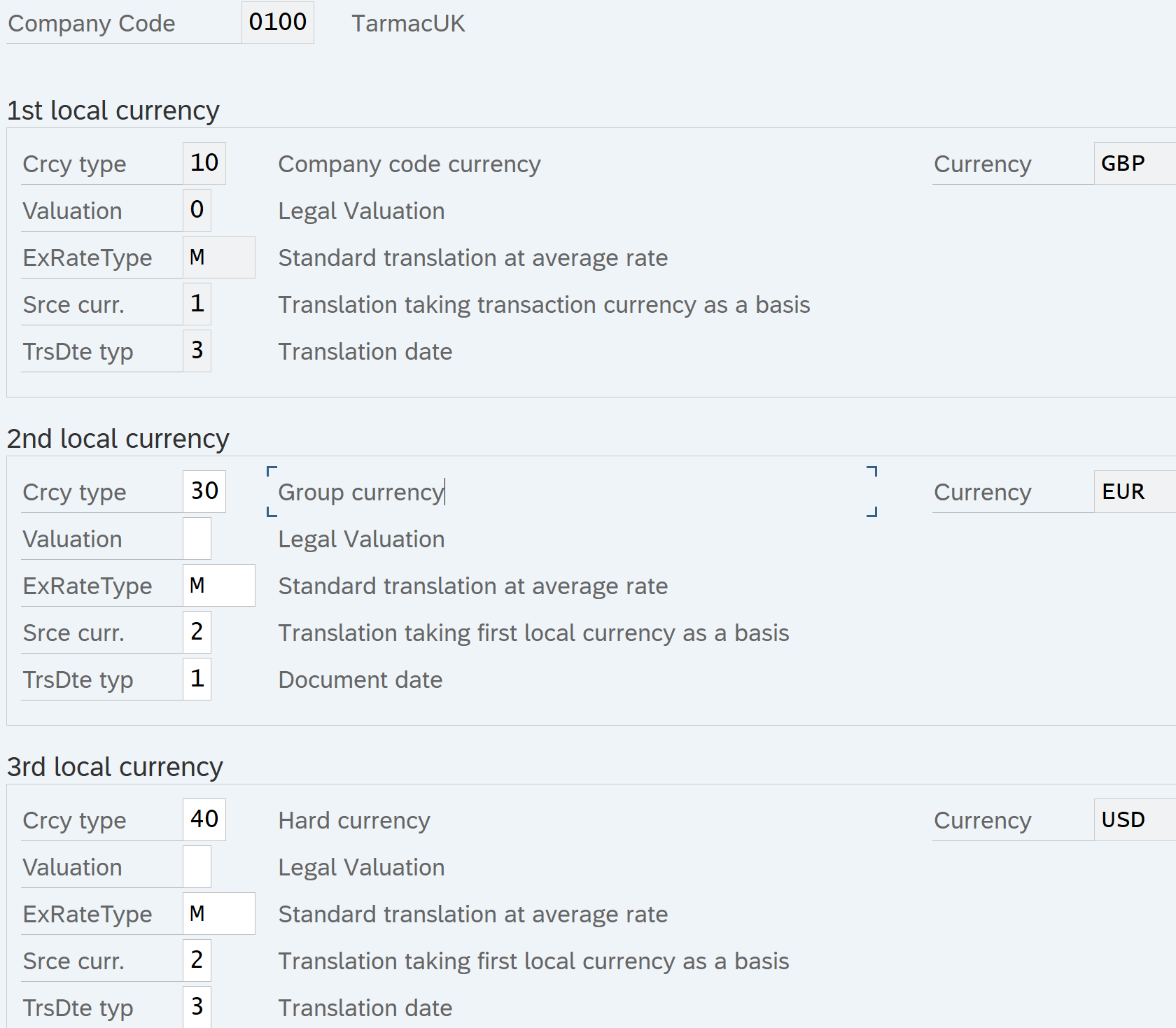

Configure Parallel currencies

Transaction code: OB22

1st Local Currency

Srce curr. : Translation is taking transaction currency as base. We can also select translation using first local currency as base

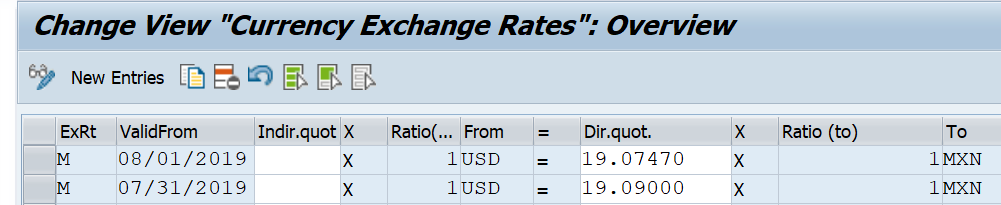

Exchange Rate Type: M. this exchange rate type will be used for currency translation at the time of monthly valuation and also when posting FI documents in a currency other than company code currency.

Enter Exchange Rate for Exchange Rate type ‘M’

Tcode: OB08

System will use the latest exchange rate

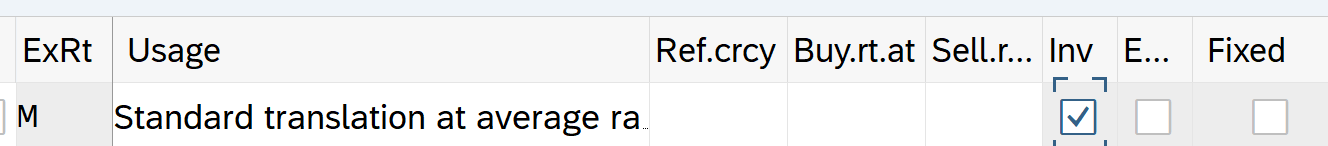

Define New Exchange Rate Type

Path: SAP Net weaver – General Settings – Currencies – Check Exchange Rate Type

Indicator that in the case of a missing exchange rate entry in the system for the required translation from one currency into another, the inverted exchange rate relationship may also be used

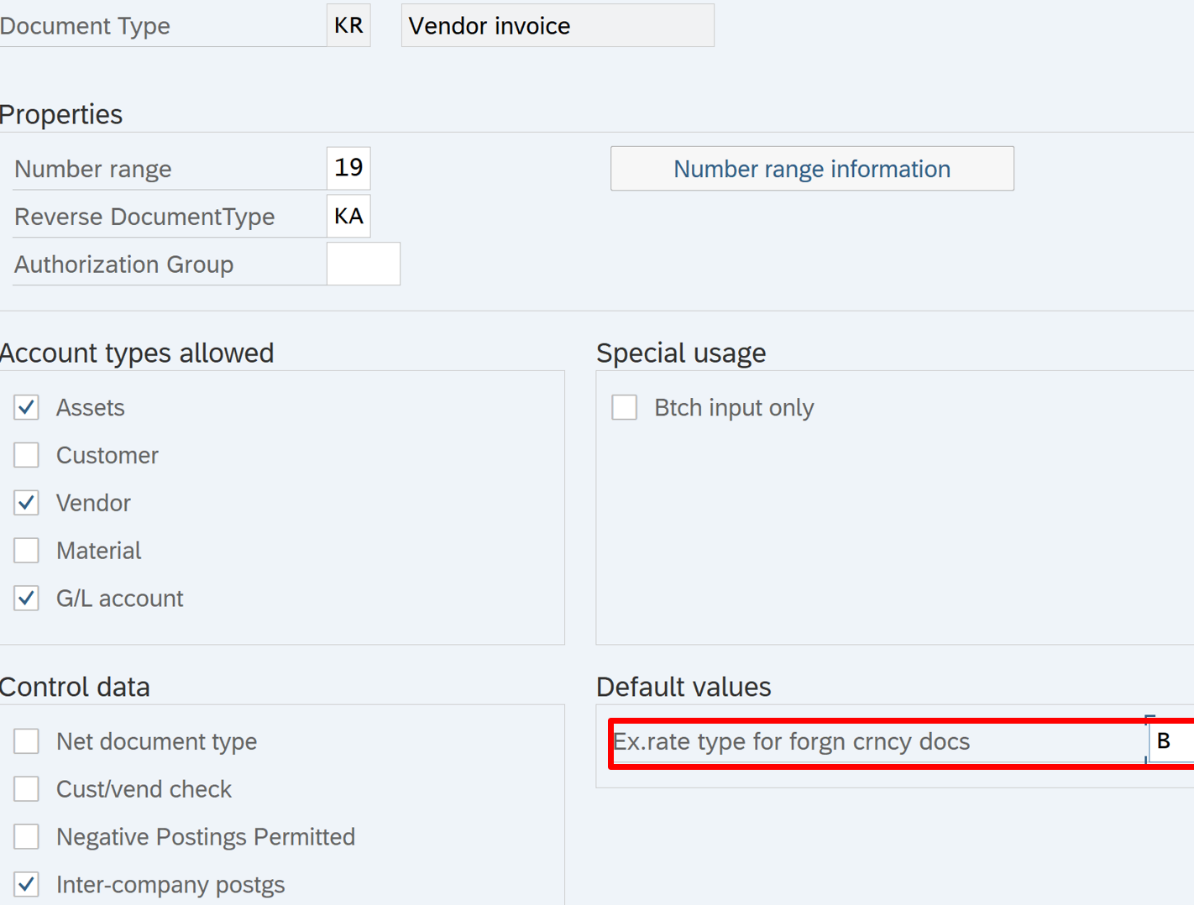

Specify Exchange Rate Type to be used by Vendor Invoice

Tcode: OBA7

We can specify the exchange rate type to be used by a specific document type ( KR) in transaction code OBA7

Let us change it to ‘M’

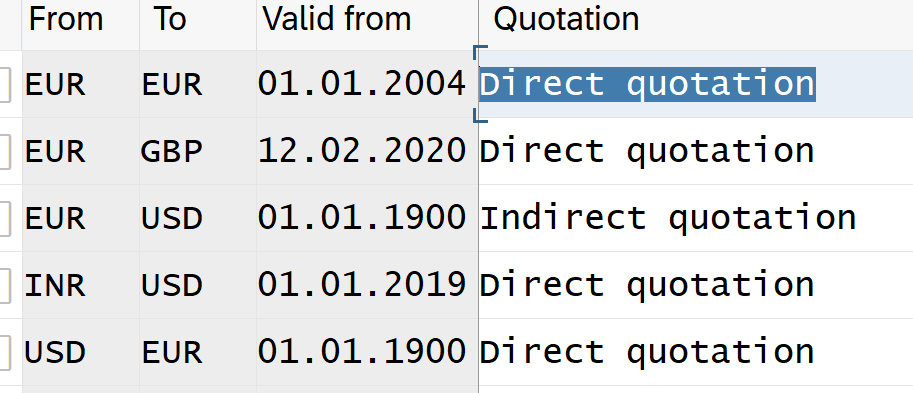

Specify whether Direct Quote or Indirect quote

Path: SAP NetWeaver – General Settings – Currencies – Define Standard quotation for exchange rate

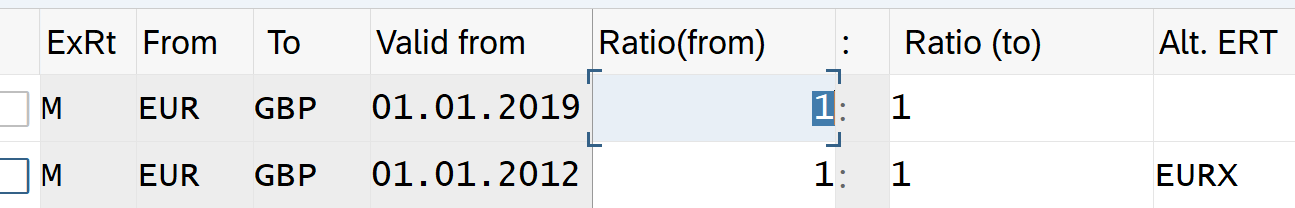

Define Translation ratios between currencies

Path: SAP NetWeaver – General Settings – Currencies

Always use SAP default

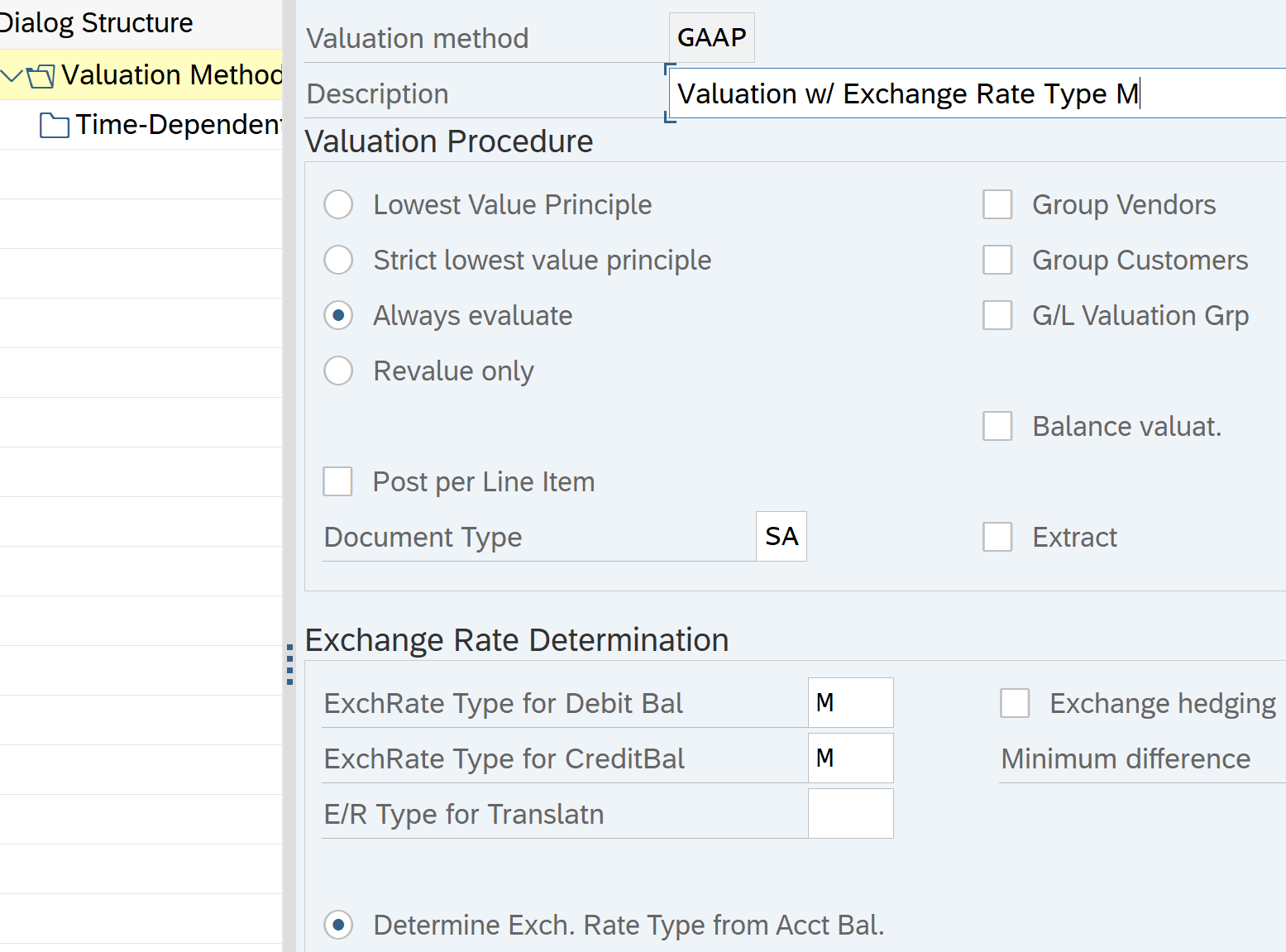

Valuation Method Setup

Path: SPRO- Financial Accounting (New) – General Ledger Accounting (New) – Periodic Processing – Valuate – Define Valuation Methods

Tcode: OB59

Here define Foreign Currency Valuation method for Open Items

Valuation Procedure:

- Lowest Value Principle: If selected valuation is done only if the exchange rate difference results in exchange rate loss. Valuation posted only if giving negative result

- Always evaluate: Exchange rate difference always posted whether gain or loss

- Revalue Only: The opposite of the first one, valuation is only posted when positive

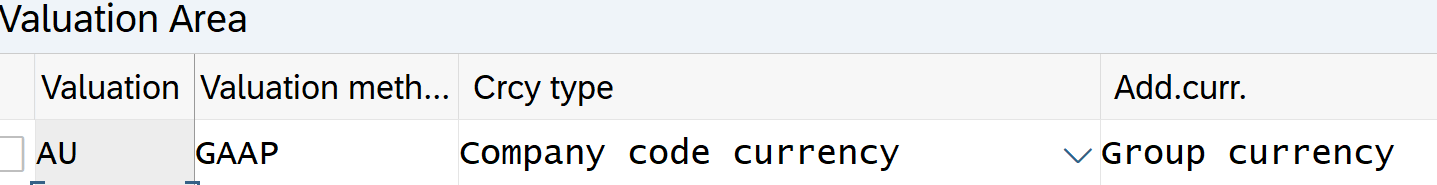

Define Valuation Area

Path: SPRO- Financial Accounting (New) – General Ledger Accounting (New) – Periodic Processing – Valuate- Define Valuation Areas

Define valuation area for closing operations

Assign Valuation method defined in last step to the valuation area

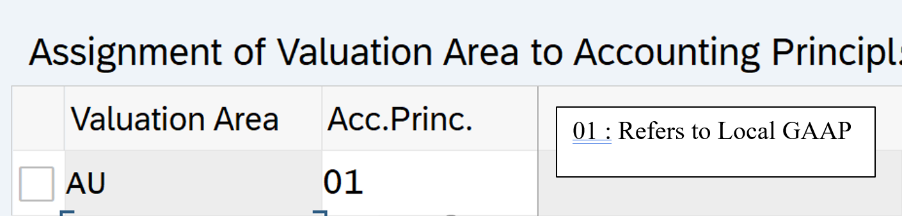

Assign Valuation Area (RM/RU) to accounting principles

Path: SPRO- Financial Accounting (New) – General Ledger Accounting (New) – Periodic Processing- Assign valuation area to accounting principles

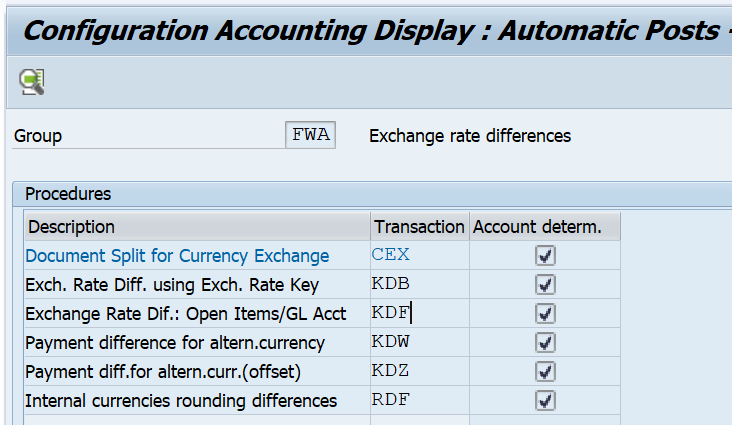

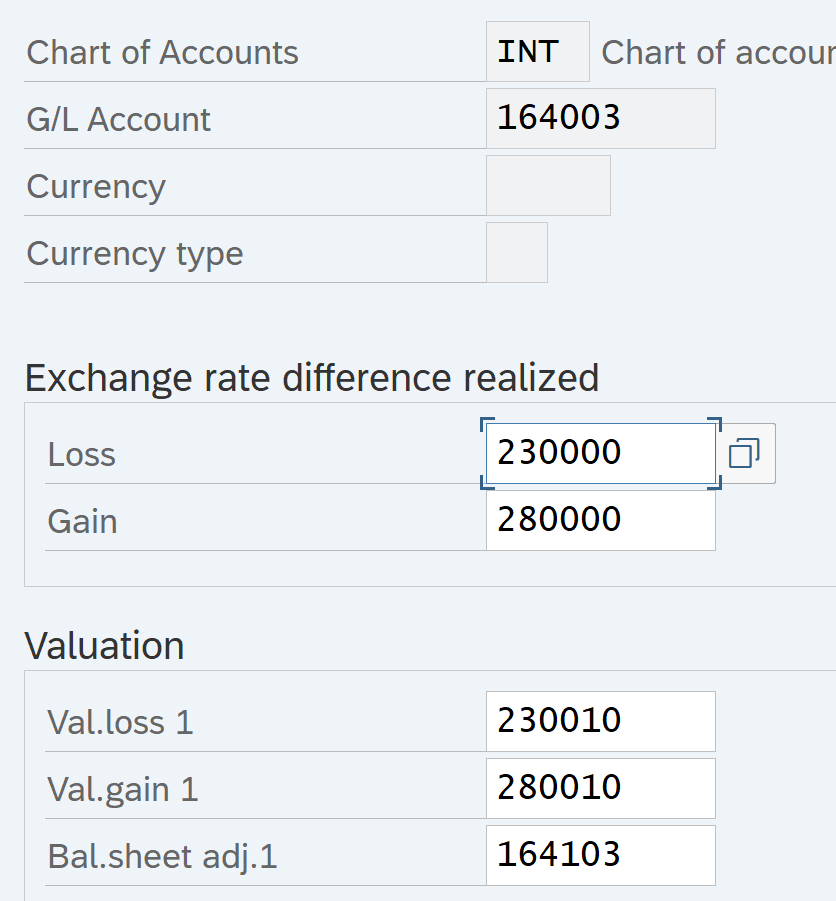

Account Determination for Open Item Exchange rate differences

Path: SPRO- Financial Accounting (New) – General Ledger Accounting (New) – Periodic Processing – Valuate- Foreign Currency Valuation – Automatic Posting for foreign currency valuation

Tcode: OBA1

Select transaction ‘KDF’

Here we have Customer / Vendor reconciliation accounts. For these automatic postings at time of foreign currency, revaluation must be specified

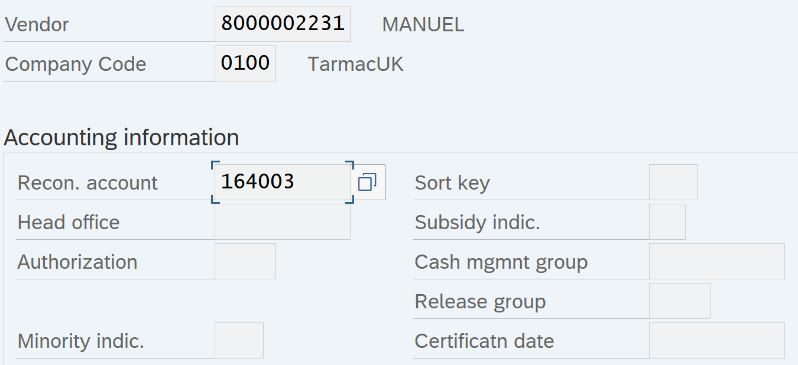

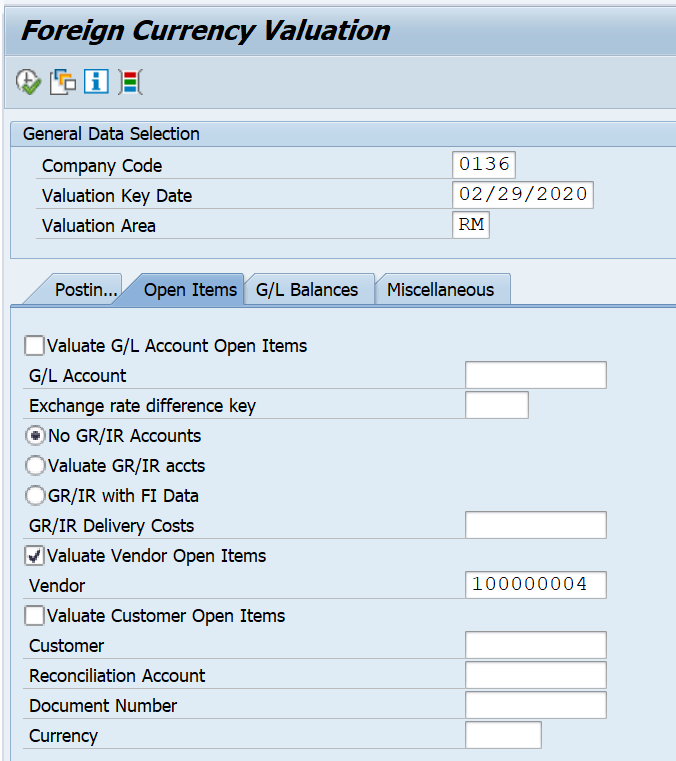

Vendor Master: XK03

Account Determination Open Item: OBA1

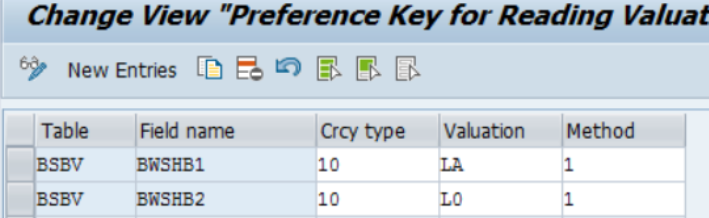

Additional Settings to display valuation differences in FBL1N/ FBL5N

Tcode: OB_9

These fields must also be defined as special fields in the line item display (table T021S – see SAP note 984305 for more details

Month End Foreign Currency Valuation Run

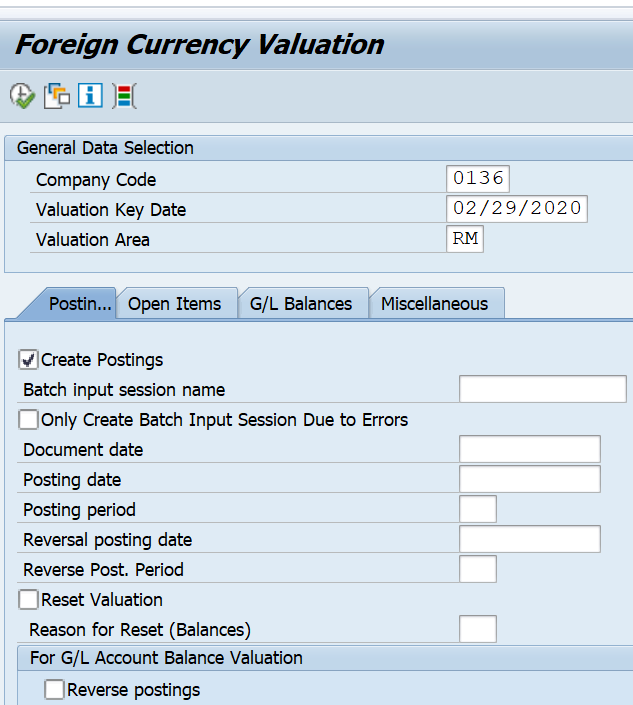

Tcode: FAGL_FC_VAL

Post a foreign transaction vendor Invoice FB60

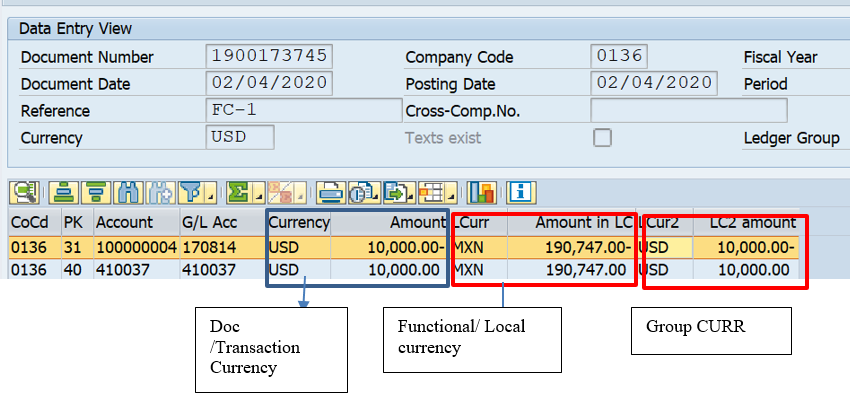

Company Code: 0136

Co. code currency: MXN

So if document posted in USD => Foreign currency transaction

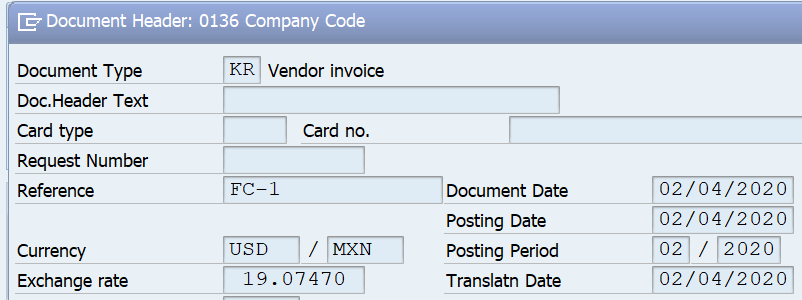

Exchange Rate used and validation:

Table TCURR

Transaction code: OB08

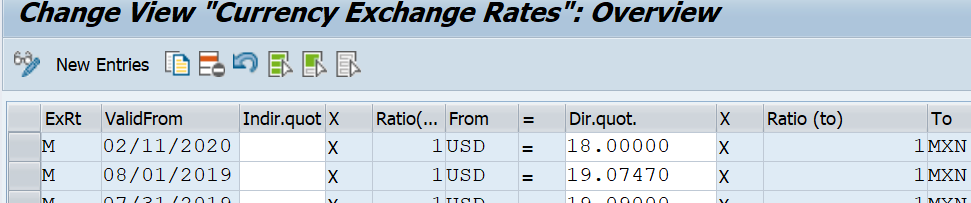

Update Exchange rate in OB08

Let us update exchange rate from USD to MXN to 18.0

Tcode: OB08

Run month end foreign currency valuation for Open Invoices

Tcode: FAGL_FC_VAL

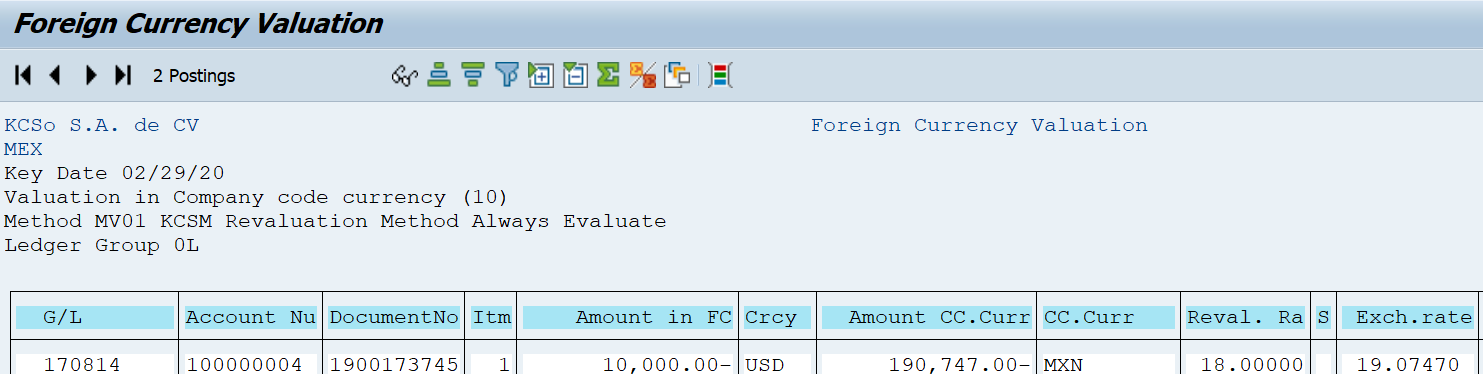

This revaluation was in company code currency (10): MXN

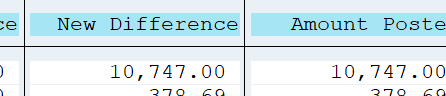

Invoice value in MXN @ 19.07 = 190,747

Invoice value in MXN @ 18 = 180,000

Difference 10,747 posted through FI#4700158132 and then reversed

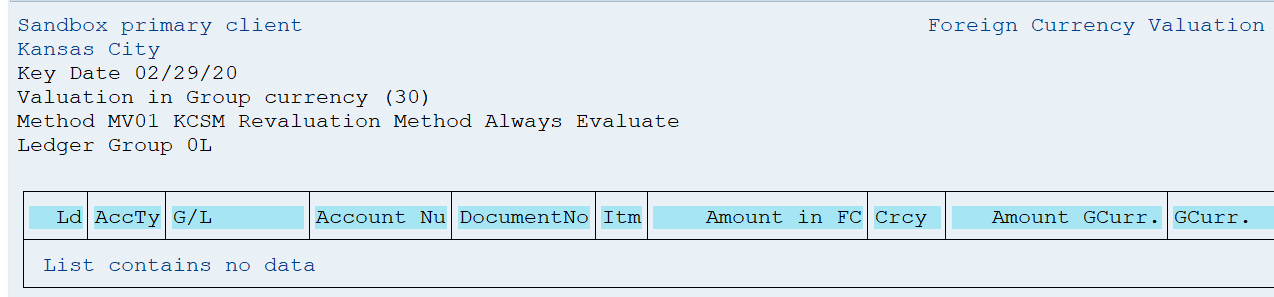

Revaluation in-group currency (30): USD

As the group currency (USD) is same as transaction currency (USD), no revaluation postings are made

Example 2

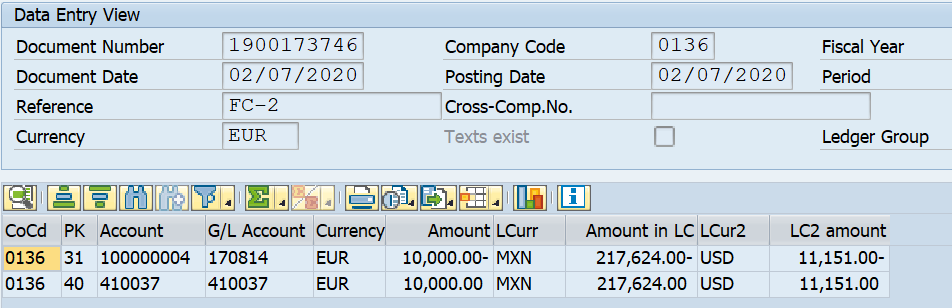

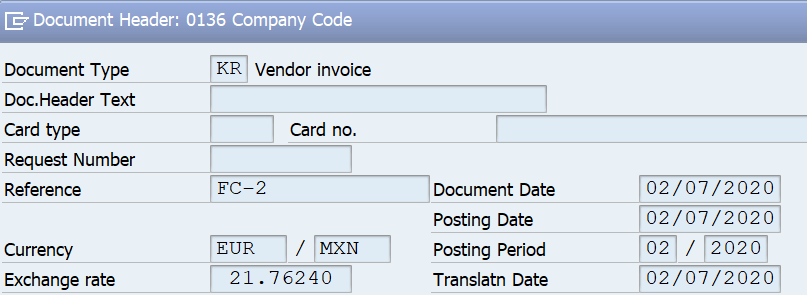

Post to company code 0136 (Co. Code currency MXN, Group/ Reporting currency USD) in EURO

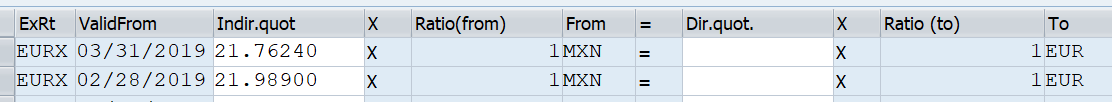

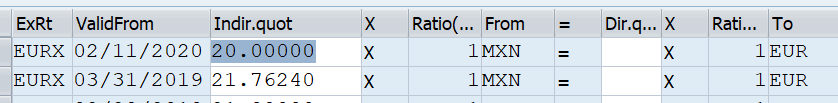

Exchange rate: OB08

As the direct rate is not available system went to next step and used indirect rate

Let us update it to 20 in transaction code OB08

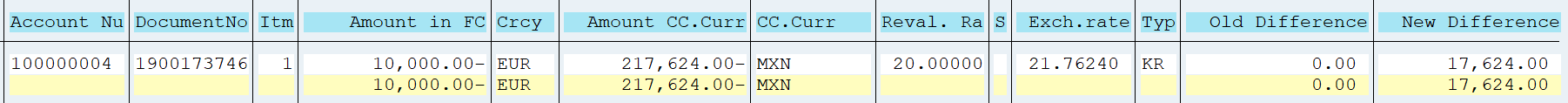

ME Foreign Currency Valuation

10000 EUR revalued @ 20 and difference posted and then reversed

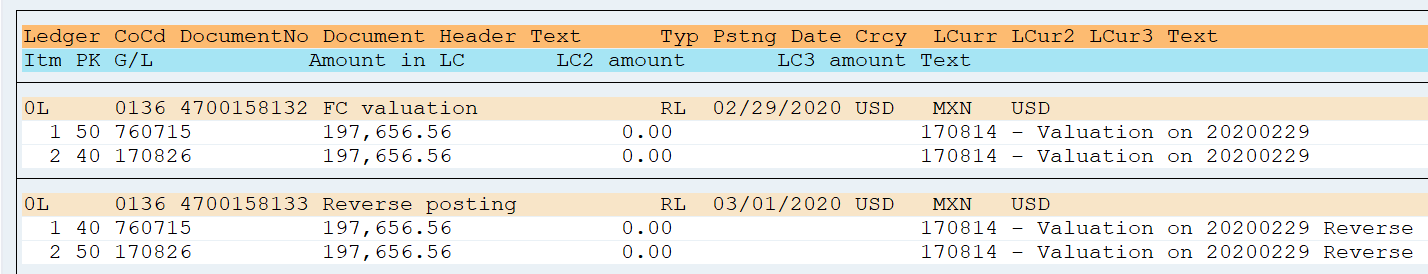

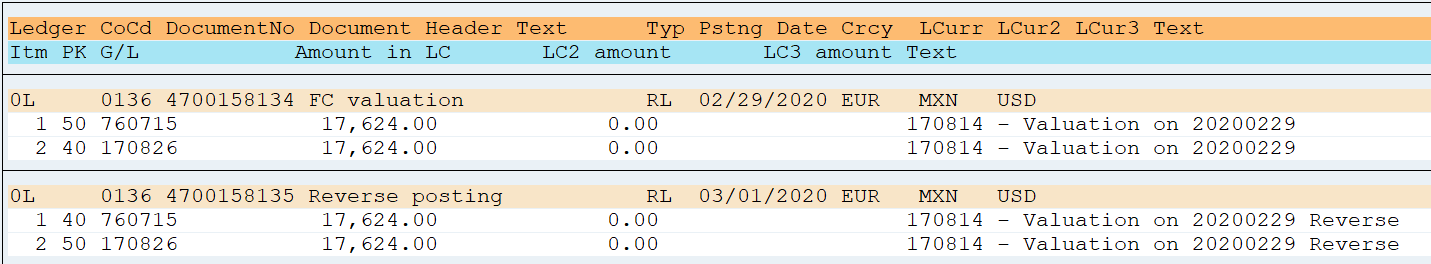

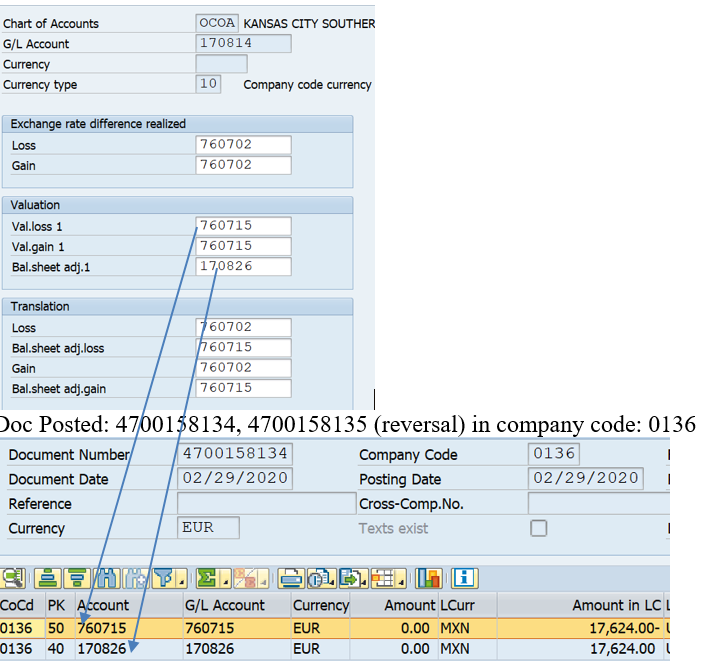

Validate GL Accounts Posted

Tcode: OBA1

Unrealized loss posted to 760715 (BS) and to balance it debit side posted to 170826 (Balance sheet acct). This is reversed in the next period.

Please visits next post on SAP Controlling

Pingback: Course Material - AIERP1