Money Market

Money market transactions are used for short and medium term Investments and for borrowing of funds. Key money market instruments are as listed below:

- Fixed Term Deposit

- Commercial papers

- Deposit at Notice

- Interest rate Instruments

Fixed term Deposits: A Fixed term deposit is an investment that includes the deposit of money into an account at a financial institution. Term deposit investments usually carry short-term maturities ranging from one month to a few years. Investors can withdraw funds only at the end of term

Commercial Papers: A Commercial paper is an unsecured, short-term debt instrument issued by a companies for the financing of accounts payable and inventories and meet short-term liabilities. Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates

Deposits at Notice: These investments are similar to fixed term deposit. However, money can be withdrawn only after advance notice period has expired. For e.g. If you have a 50-day notice deposit account, you ca withdraw money only after 50 day withdrawal notice period has expired

Interest rate Instruments: An interest-rate instrument is a derivative where the underlying asset is the right to pay or receive a notional amount of money at a given interest rate. Its value increase / decrease based on movement of the interest rate

We will understand Money Market configuration and business process by configuring a new Fixed Term deposit and Interest Rate instruments. Test various associated business Process. Later we will also configure Intercompany loans in Money Market Instruments

Configure Treasury in SAP

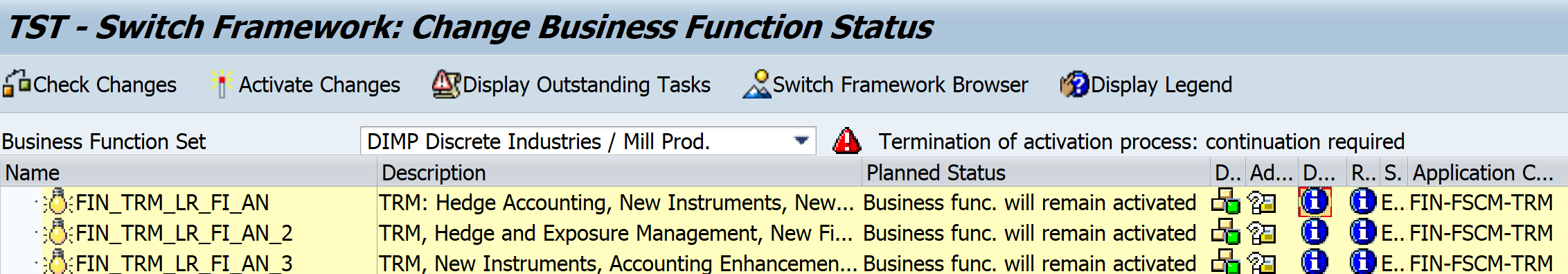

Activate Treasury Functions in SAP

Path: SPRO- Activate business functions – Continue – Enterprise Business functions -Activate below functions

- FIN_TRM_LR_FI_AN

- FIN_TRM_LR_FI_AN2

Fixed term Deposits

Define Product Type Path

Explanation

Product types help to differentiate between different Money Market financial instruments. In Money Market area, the following product categories are available in standard SAP

- 510 Fixed-term deposits

- 520 Deposits at notice

- 530 Commercial Paper

- 540 Cash flow transaction

- 550 Interest rate instrument

We will create new product Type as below

- ICI – Intercompany Loan by the Lending Company

- ICB – Intercompany loan by the Borrowing Company

Path: FSCM- TRM – TM – MM – TM – Product Type – Define Product Type

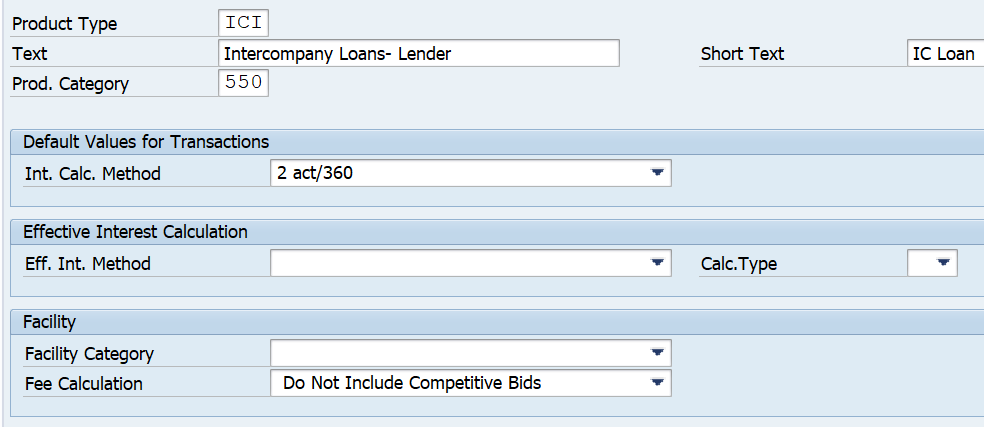

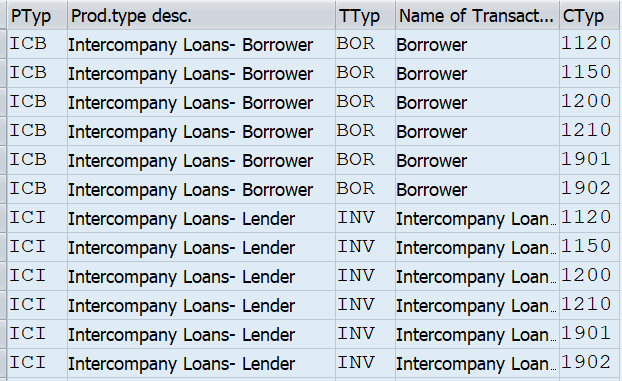

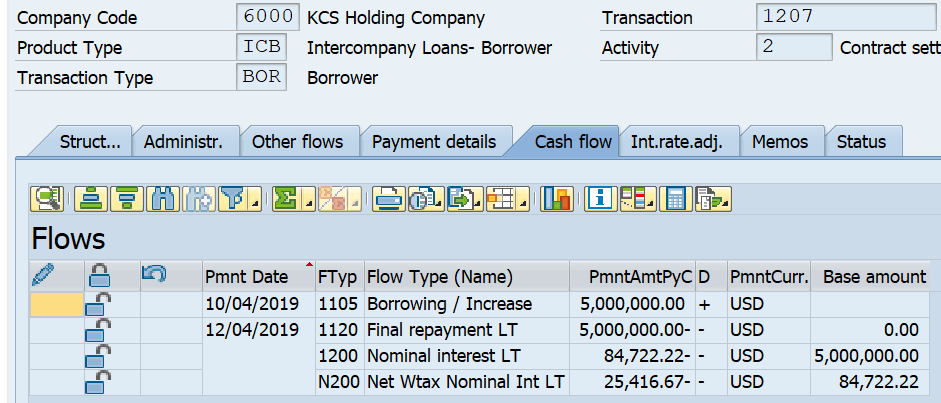

Intercompany Loans- Lender

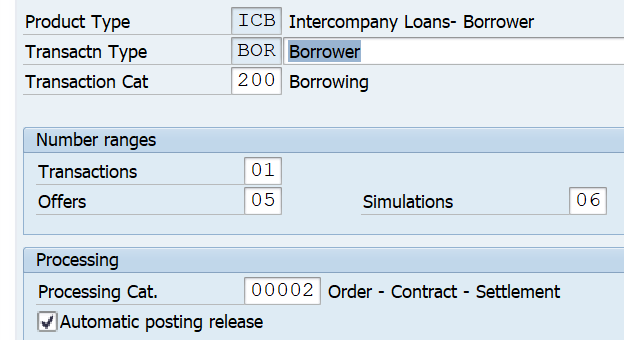

Intercompany Loans- Borrower

In Calc. Method: This drives day count for interest calculation.

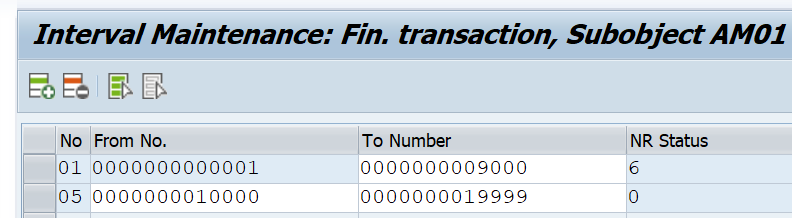

Define Number Ranges

Path: FSCM – TRM – TM – MM – TM – Transaction Type – Define Number Ranges

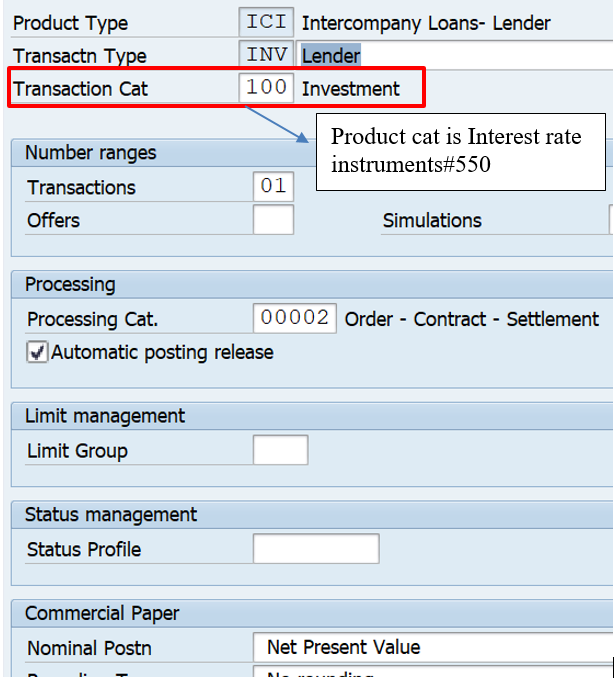

Define Transaction Types

Explanation: Transaction Type is assigned to a Product Type. Transaction Type define the direction of the Trade. For Lending Company Transaction type will be INV (Investment) for Borrowing Company Transaction type will be BOR (Borrowing)

Path: FSCM – TRM – TM – MM – TM – Transaction Type- Define Transaction Type

Transaction Type for borrowing side as below:

Define Flow Types

Path: FSCM – TRM – TM – MM – TM – Flow Types- Define Flow Types

Explanation

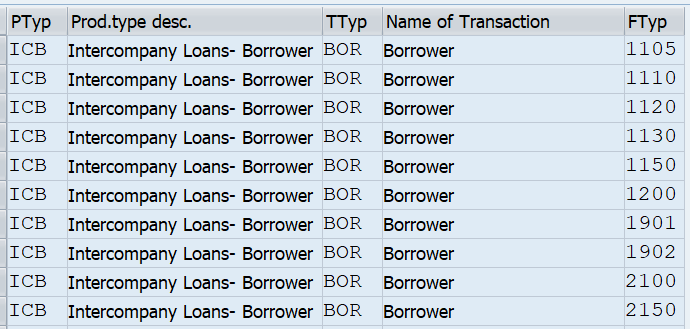

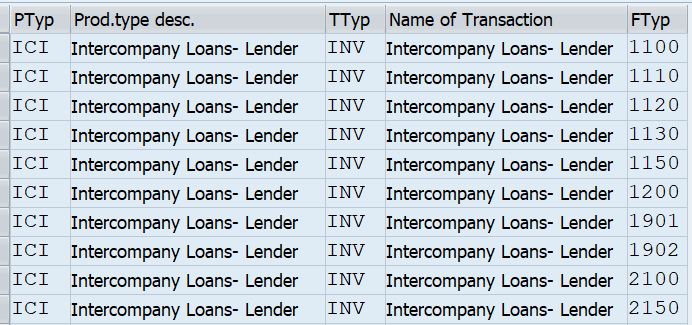

Flow types represent different types of flows related to interest rate instruments. We will copy from SAP standard Flow types as below to create New Flow Types

We will use the SAP standard flow types as given below:

| s.no. | Flow Type | Description |

| 1105 | Borrowing / Increase | |

| 1110 | Principal Decrease | |

| 1120 | Final repayment LT | |

| 1130 | Installment repayment LT | |

| 1150 | Interest capitalization | |

| 1200 | Nominal interest LT | |

| 1901 | Charges | |

| 1902 | Facility Admin Fee | |

| 2100 | Interest accrual | |

| 2150 | Interest accrual: Reset | |

| 1100 | Principal Increase | |

| N200 | With Holding tax | |

Assign Flow Types to Transaction Types

Path: FSCM – TRM – TM – MM – TM – Flow Types- Assign Flow Types to Transaction Types

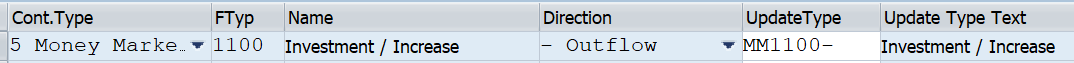

Define Update Type and Assign Usage

Two steps performed in this step

- Define Update Type

- Assign usage to update type

Path: SPRO- FSCM – TRM – TM – MM – TM – Update Types – Define Update Types

SAP standard update types have been used as listed below:

| Update Type | Description |

| MM1105+ | Borrowing / Increase |

| MM1100- | Investment / Increase |

| MM1120 + | Investment / Final Repayment |

| MM1120 - | Borrowing / Final Repayment |

| MM1130 + | Investment / Instalment Repayment |

| MM1130 - | Borrowing / Instalment Repayment |

| MM1150 + | Borrowing / Interest Capitalization |

| MM1150 - | Investment / Interest Capitalization |

| MM1200+ | Investment / Nominal Interest |

| MM1200- | Borrowing / Nominal Interest |

| MM1901 +/- | Charges |

| MM1902 +/- | Commission |

| MMN200- | Withholding Tax 1 |

| MMN200+ | Withholding Tax |

| AD1000 | Accrual Revenue |

| AD1001 | Accrual Revenue- Reset |

| AD1002 | Accrual Expense |

| AD1003 | Accrual Expense Reset |

Assign Update Type to Usages

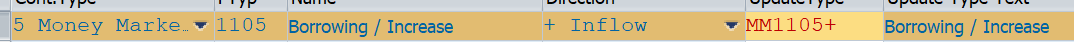

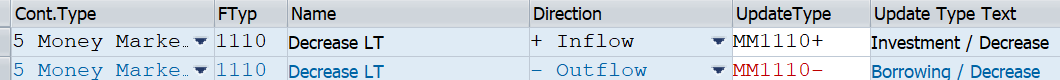

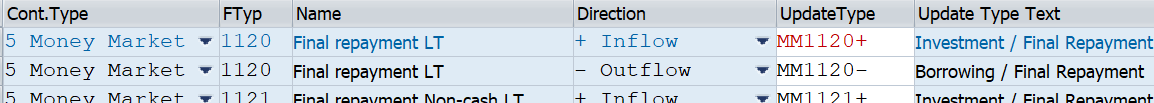

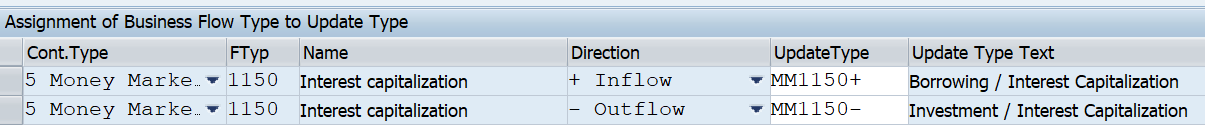

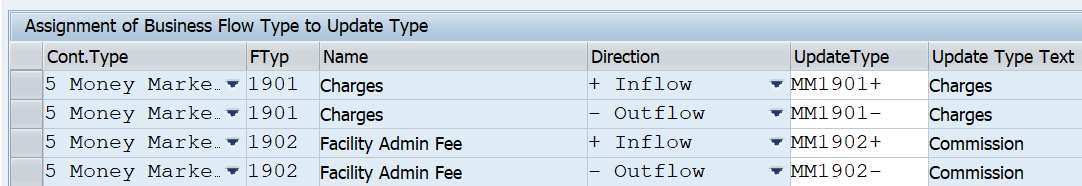

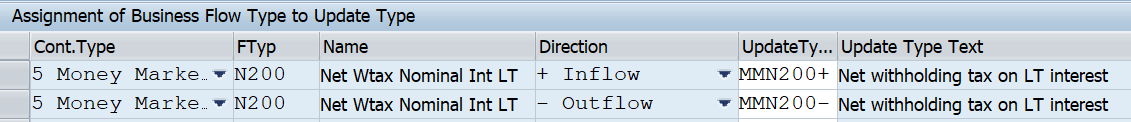

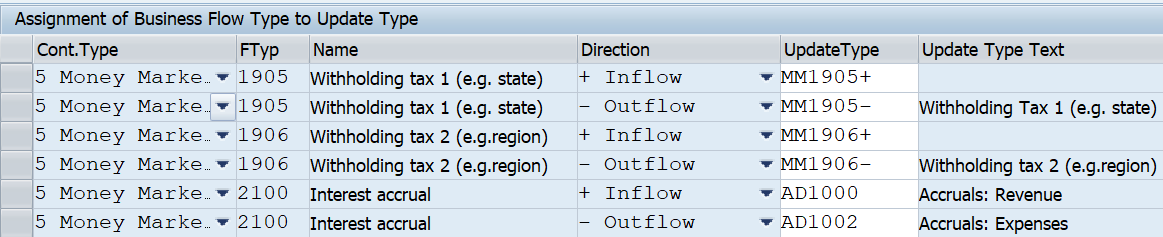

Assign Flow Types to Updates Types

In this step assign direction (Inward / outward flow) to update type

Path: SPRO- FSCM – TRM – TM – MM – TM – Update Types- Assign flow Types to Update Types

Click new entries and enter the below data

Define condition Types

Path: SPRO- FSCM – TRM – TM – MM – TM – Condition Types – Define Condition Types

Functionality: condition Types used for Intercompany loans are Fixed Interest rates, Floating interest rates, Final repayment of principal

We will create new condition types by copying SAP standard condition types as per table below:

| SAP STD Cond type | New Cond Type | Cond Type Name | Generated Flow Type | Flow Cat |

| 1120 | 1000 | Final Repayment | PF00 | |

| 1200 | 2000 | Nominal Interest | IN00 | |

| 1210 | 2010 | Interest Rate Adjustment | <BLANK> | |

| 1901 | - | Charges | 1901 | 90-Other Flow |

| 1902 | - | Commissions | 1902 | 90-Other Flow |

Assign Condition Types to Transaction Types

Path: SPRO- FSCM – TRM – TM – MM – TM – Condition Types- Assign Condition types to Transaction types

In this step, assign the condition types created in last step to Product Type and Transaction Types created in earlier steps

Transaction Manager Configuration

General Transaction manager configuration, which must be done to use Transaction manager. This is not specific to product type

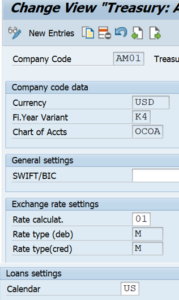

Define Company Code Additional data

Path: SPRO – FSCM – TRM – TM – General Settings – Organization – Define Company Code Additional data

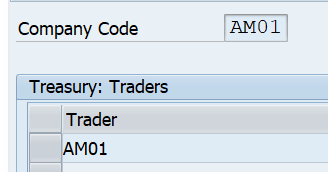

Define Traders

Path: SPRO – FSCM – TRM – TM – General Settings – Organization – Define Traders

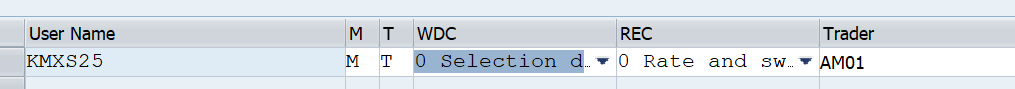

Define User Data

Path: SPRO – FSCM – TRM – TM – General Settings – Organization- Define User data

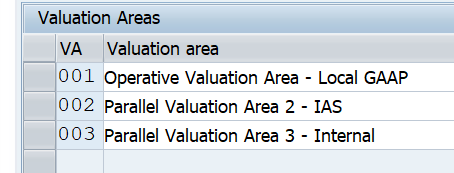

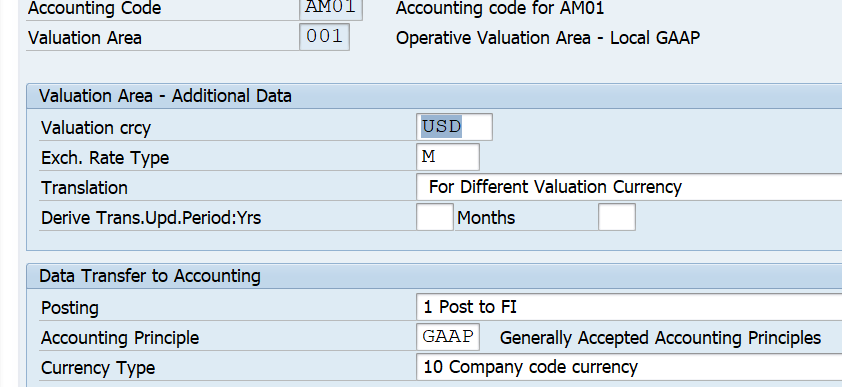

Define Valuation Area

Path: SPRO – FSCM – TRM – TM – General Settings – Accounting – Organization – Define Valuation Area

Define Accounting Codes

Path: SPRO – FSCM – TRM – TM – General Settings – Accounting – Organization –Define Accounting Codes

Add the company codes involved in intercompany loans as accounting codes

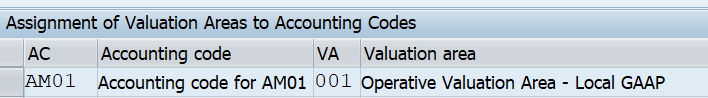

Assign accounting Codes and Valuation Area

Path: SPRO – FSCM – TRM – TM – General Settings – Accounting – Organization –Assign Accounting codes to valuation Area

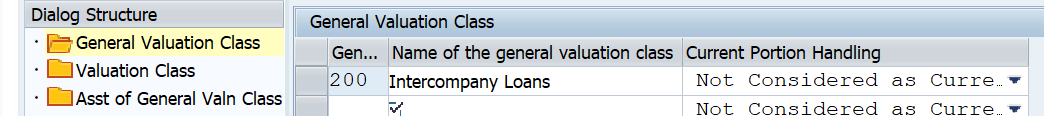

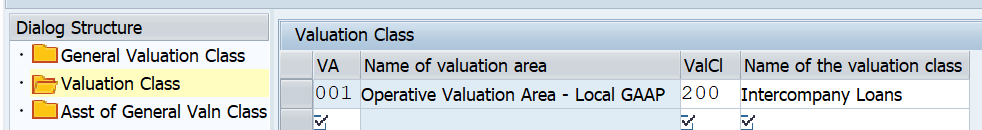

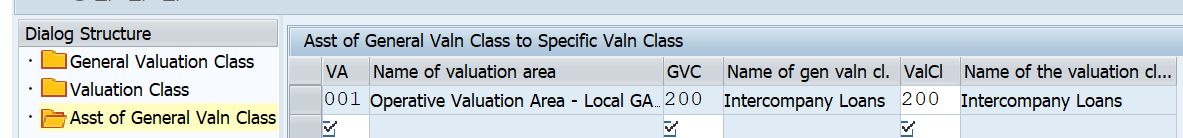

Define and Assign Valuation Classes

Functionality:

- General Valuation class drive the assignment of the position management procedure which is significant to the valuation and accounting of trades

- For e.g. accounting treatment is different if the Trade is designated as Trading, Available for Sale, Held to Maturity

- We need to create separate General Valuation class for above Trade categories.

- General Valuation class is than assigned to Valuation area

Path : SPRO – FSCM – TRM – TM – General Settings – accounting – Settings for Position Management – Define and assign valuation class

Now select the row and make below entries

Select the row and make below entry

Assign General Valuation Class

Path: SPRO- FSCM – TRM – TM – MM – TM – Assign General Valuation Class

Make the below entries

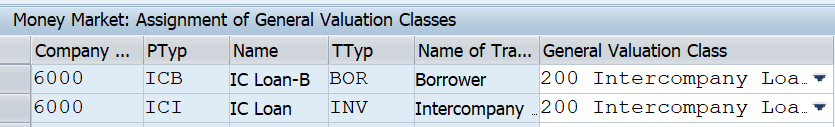

Set the Effects of the Update Types on the Position Components

Functionality: Here you define how the system should handle changes like increase / decrease in principal

Path: FSCM – TRM – TM – general Settings – Accounting –settings for Position Management – Set the Effects of the Update Type on the Position Components

SAP Default

Similarly SAP default for other update types

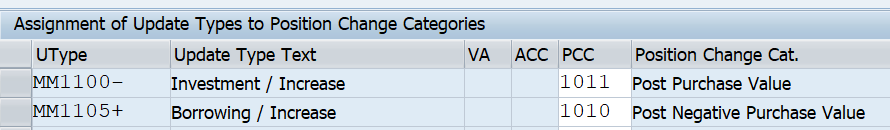

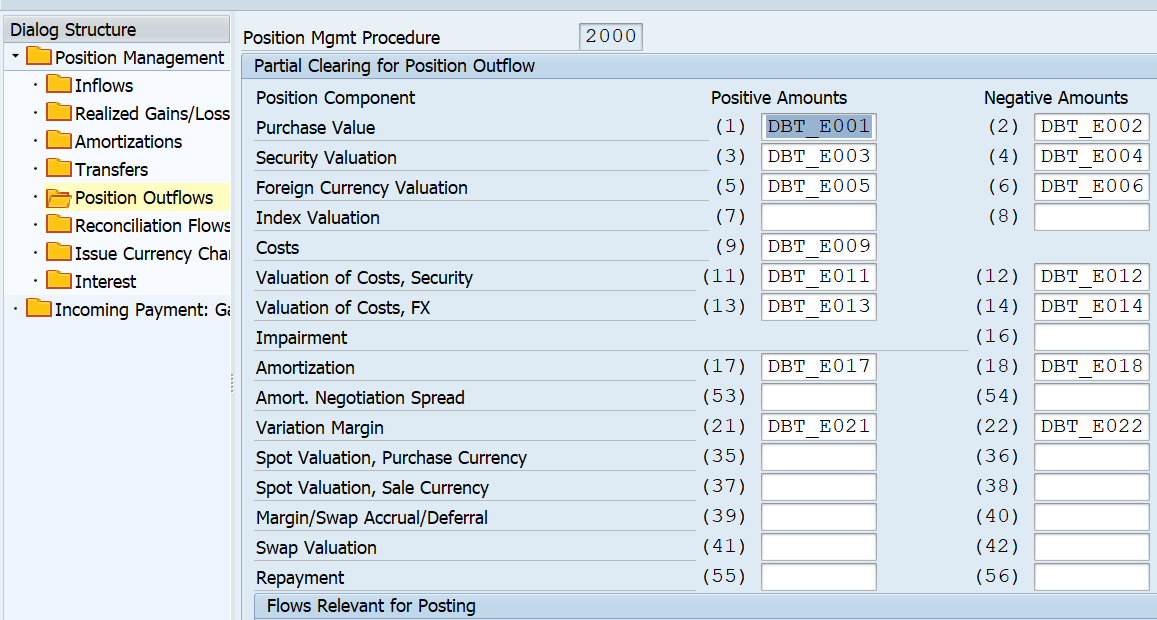

Define a Position management Procedure

This Functionality drives how Trades are values at month end. How derived business transactions such as withholding tax are generated

Path: SPRO – FSCM – TRM – TM – General Settings – Accounting – Settings for Position Management – Define Position management procedure

We will use SAP default for Fixed Term deposits

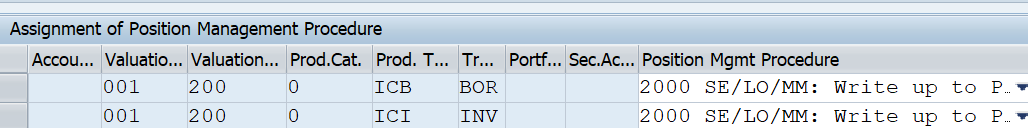

Assign the Position management Procedure

Path: SPRO – FSCM – TRM – TM – General Settings – Accounting – Settings for Position Management- Assign Position Management Procedure

Assign Update Types for Derived Business Transactions

Example of derived business transactions are: realized gain / loss, partial position sales, security account transfers etc.

Path: FSCM – TRM – TM – General Settings – Accounting – Derived Business Transactions – Updates Types - Assign Update Types for Derived Business Transactions

New Entries – Enter the position management procedure created in earlier step – Save

Double Click Position outflow folder in the left panel and add SAP defined update types as shown below:

Using SAP Default position Management:2000

Processing of Derived Business Transactions

Path: FSCM – TRM – TM – General Settings – Accounting – Derived Business Transactions – Control of processing of Derived Business Transactions

Enter the below data and save

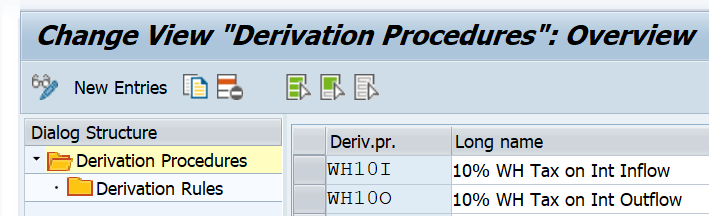

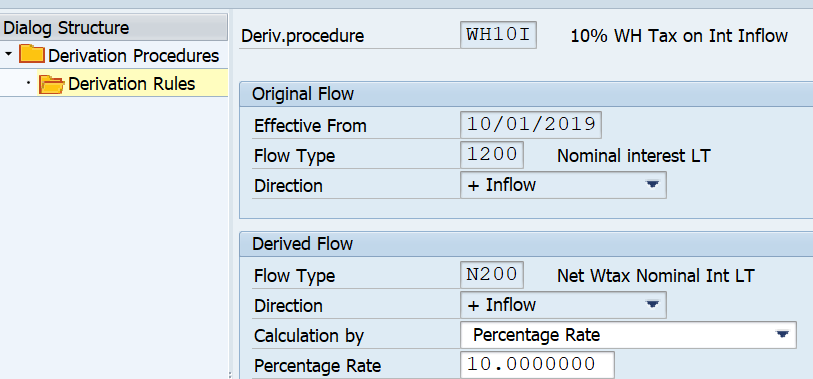

With Holding Tax Posting and Configuration

Path

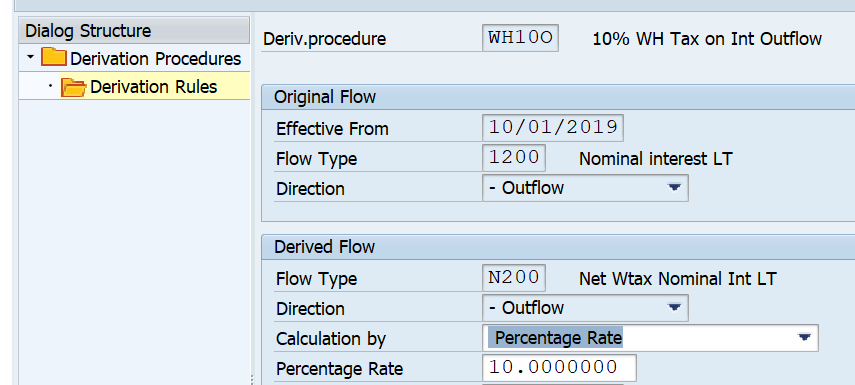

FSCM- TRM – TM - MM – TM – FT – Derived Flows – Define Derivation Procedure and Rules

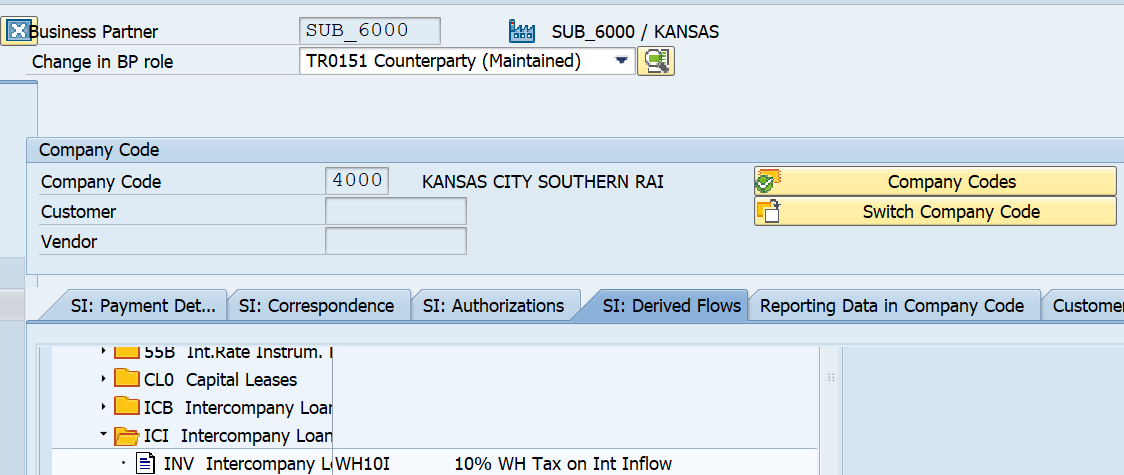

Inflow assigned to Transaction Type INV to Business Partner

WH Tax on Interest Outflow

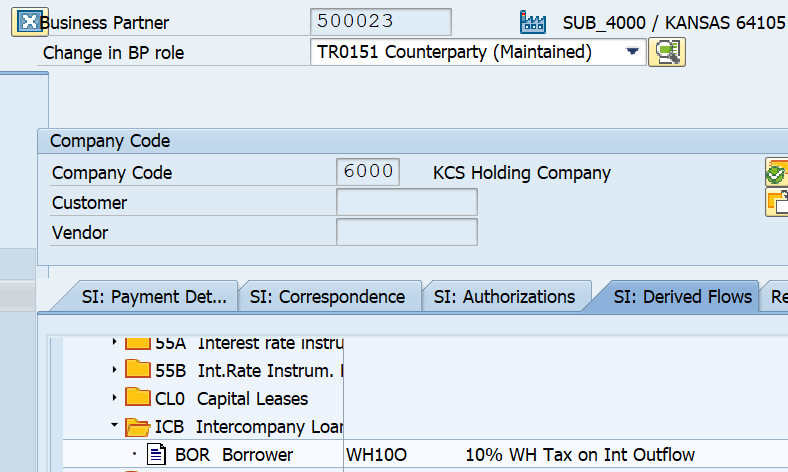

Assign to Transaction Type BRO to Business Partner

Can define any number of WH Tax rates here

These have to be assigned to Original flow type 1200 (Nominal Interest) as this flow type is assigned to our product type ICI / ICB

Derived flow type is N200. This is assigned to Update type MMN200+ /-

As in, the above scenario WH Tax is going out, it will be assigned to BP of the borrowing company code. Company code paying the interest

Mirroring Configuration

Functionality: With this configuration, if you enter intercompany loan on investing side, SAP automatically creates opposite intercompany loan on the borrowing side

However all subsequent processing should be done to both the loans

Activate below BADI to implement Mirror Transactions

SE18-BADI# FTR_MIRROR_DEALS

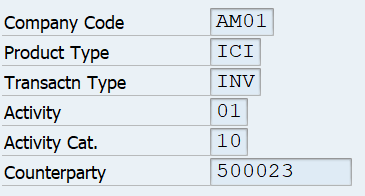

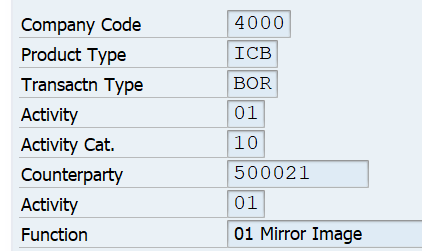

Business Scenario for Intercompany Loans

- Lending Company Code: AM01

- Business Partner 500021 is created as Business Partner in Company code AM01

- Borrowing Company code: 4000

- Business Partner 500023 is created as Business Partner in company code#4000

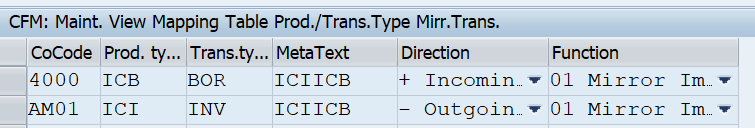

Maintain Relevant Product types and Transaction Types

Path: SPRO – FSCM – TRM – TM – General Settings – Transaction Management – Distribution of Mirror transactions - Maintain Relevant Product types and Transaction Types

Mirror transaction is triggered if below combination of Company Code; Product Type and Transaction type is satisfied

Business Partner of Company code 4000

Map Product Types and Transaction Types

Path: SPRO – FSCM – TRM – TM – General Settings – Transaction Management – Distribution of Mirror transactions -

Functionality: Here you map incoming and outgoing intercompany transactions using the META Text (ICIICB)

Process Incoming data

Path: SPRO – FSCM – TRM – TM – General Settings – Transaction Management – Distribution of Mirror transactions -

Enter the below data:

BP of company code AM01

Assign Company Code to partner

Path: SPRO – FSCM – TRM – TM – General Settings – Transaction Management – Distribution of Mirror transactions -

Comments are closed.