Table of Contents

Foreign Exchange Forward Deals- End User Training

FX Spot / Forward trade Functionality

- With spot transactions, internationally traded currencies are bought and sold on the value date at spot prices. With forward transactions, the currencies are traded at a future date at the forward price agreed at the time of the contract.

Business Scenario

- Business needs 100000 USD 3 months from now to pay a vendor 100000 USD for purchase made today. As Foreign exchange fluctuates and there is a possibility that the USD will be expensive 3 months from now, it enters into a Forward deal to buy USD 100000 3 months from now at a forward rate fixed today.

End to End Business Process for Interest Rate Instrument

| FX Spot / Forward | SAP Transaction Codes |

| Create FX Spot deal | TX01 |

| Settle FX Spot | TX06 |

| Month End Valuation | TPM60 |

| Month End- Unrealized FX Revaluation | TPM1 |

| FI Posting on contract maturity date | TBB1 |

| Realized FX Gain / Loss on Maturity | TBB1 |

| Buy / Sell Foreign Exchange | F111 |

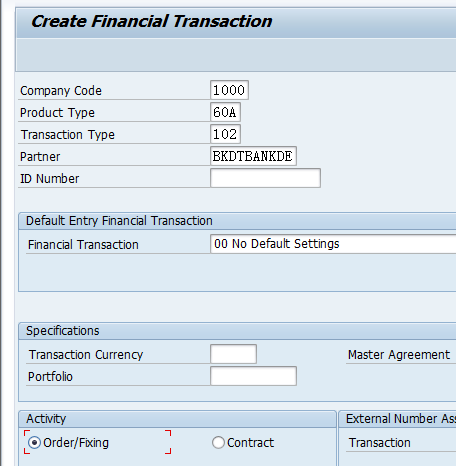

Create FX Forward trade deal

Transaction Code: FTR_Create

- Product Type: 60A for Foreign Exchange Spot or Forward deals

- Transaction Type: 102 is used for forward deals.

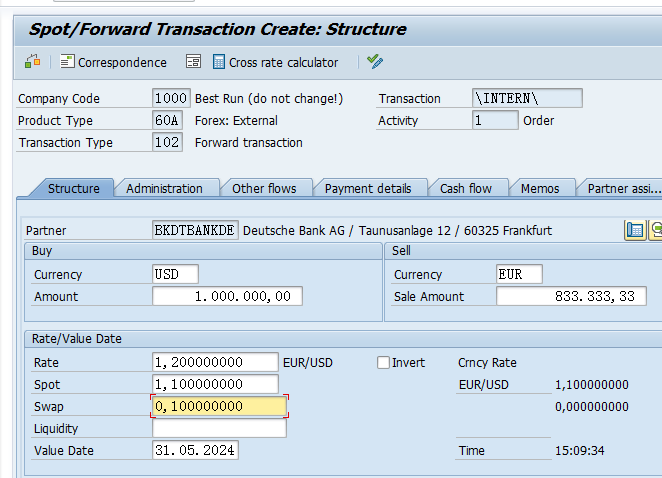

- Rate: As transaction type is 102, Rate in this field is forward rate. Forward rate is Spot rate (Today’s exchange rate plus swap Rate)

- Rate used is EUR/USD: Here leading currency is EUR. Forward Rate is 1.2 USD for 1 EUR

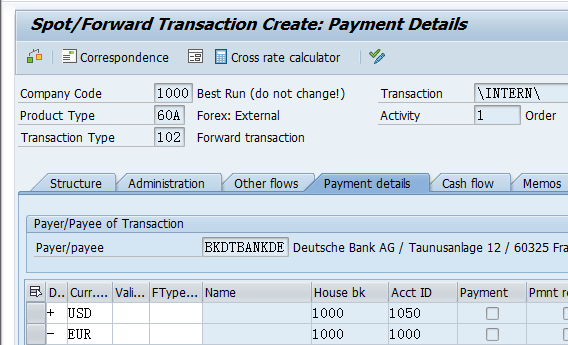

Payment Details

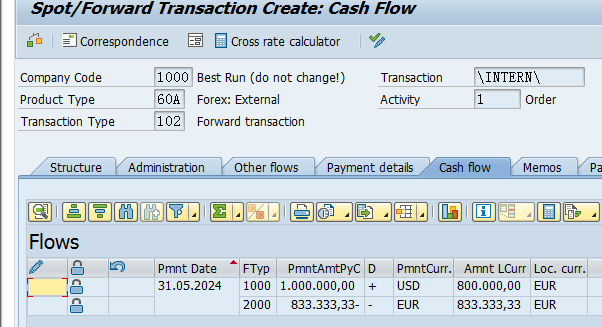

Cash Flow on Deal maturity date.

Forex transaction 4000000005962 saved in company code 1000.

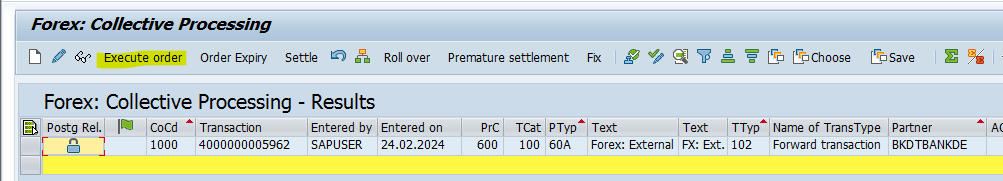

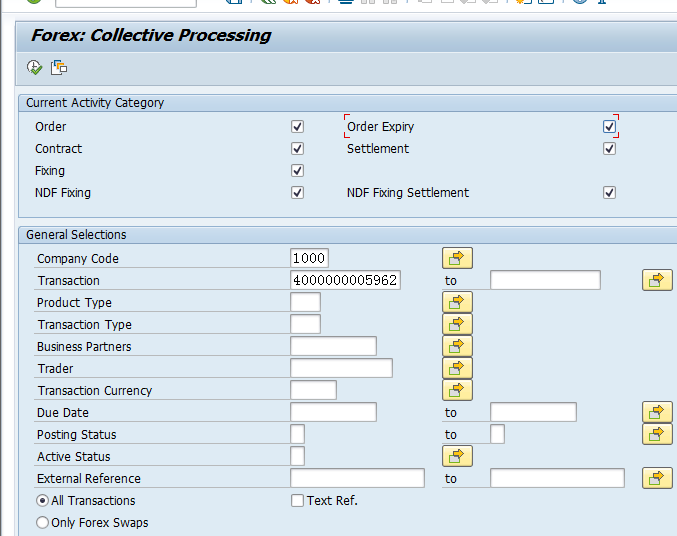

Execute FX Forward deal Order

Transaction Code: TX06

When we enter an order, we enter the transactions we intend to conclude. Unlike contracts, transactions that we intend to conclude do not necessarily have to be executed.

We need to execute the order to change the category to contract.

Click Execute Order

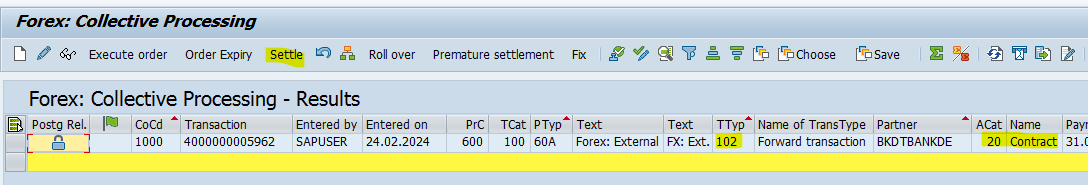

Settle FX Forward Deal

Transaction Code: TX06

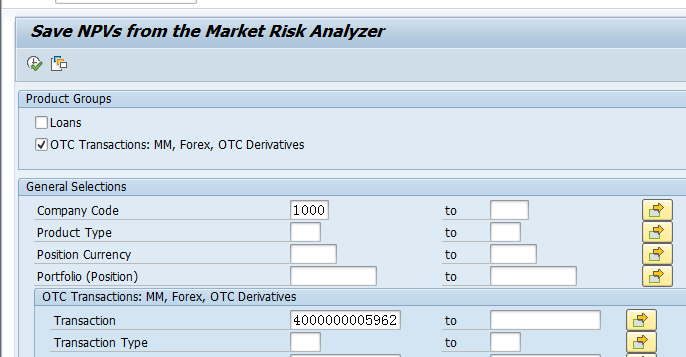

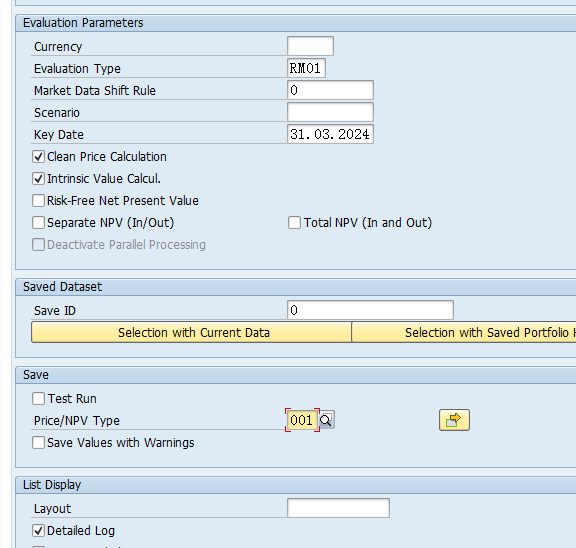

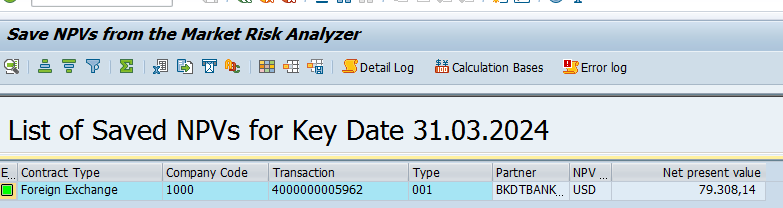

Determine Net Present Value of FX deal at Month End

Transaction Code: TPM60

In the given Forward FX deal on 31-MAY-2024 we are Buying 1 million USD and selling 833,333 EUR. Forward Exchange rate is 1.2

To Calculate NPV we will discount 1 million USD and 833,333 EUR. Discounting rate will be USD, EUR respective yield curves for the period from Maturity date (31/05/2024) to Valuation date (31/03/2024). Formula: 1/[1+interest rate*number of days between valuation date and maturity date/number of days in year].

Convert discounted USD amount to EUR by multiplying it with EUR/USD spot rate on Month end. Say this value is A. Discounted value of EUR is B.

Now NPV = A-B

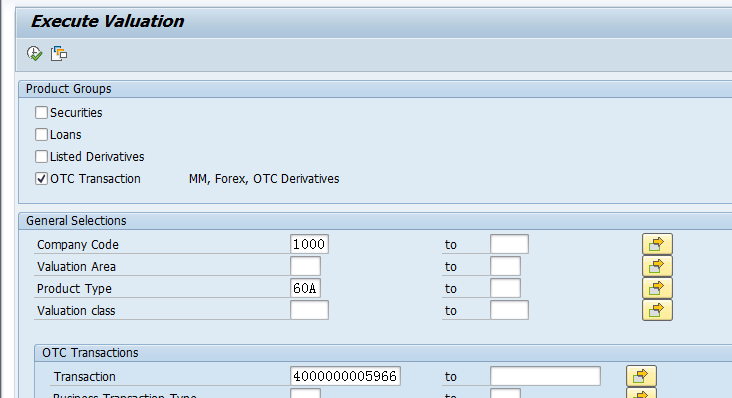

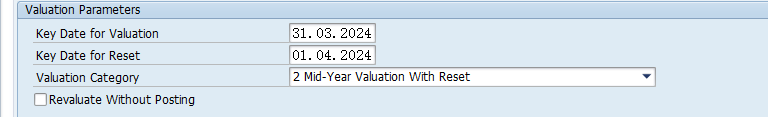

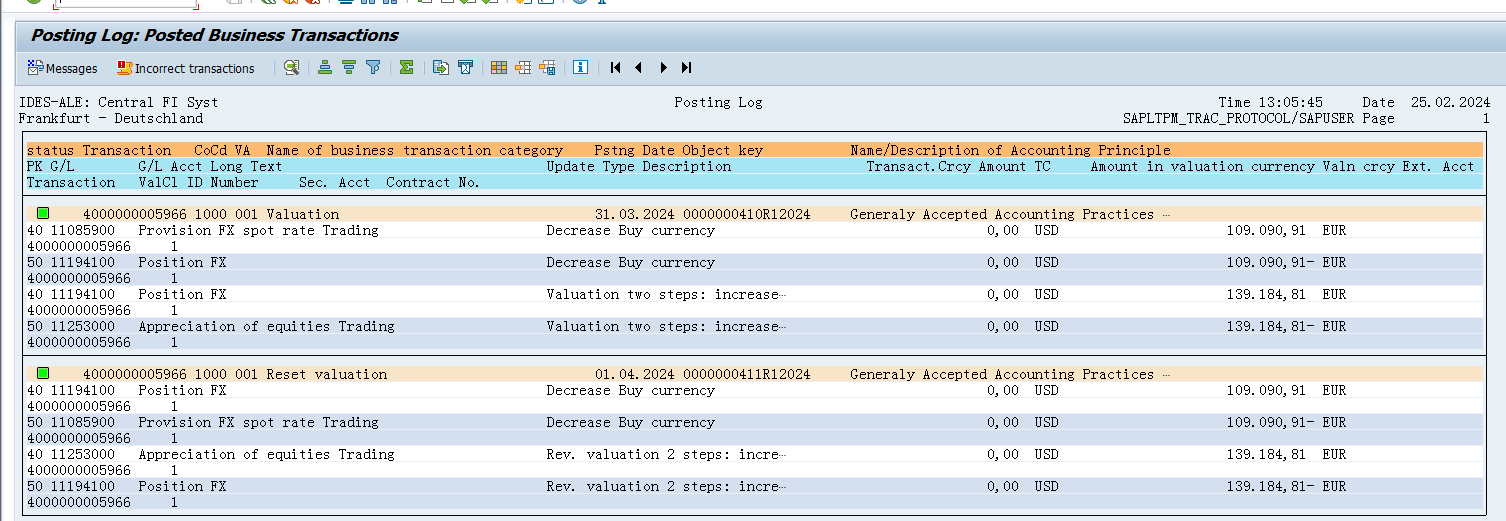

Month End- Unrealized FX Revaluation

Transaction Code: TPM1

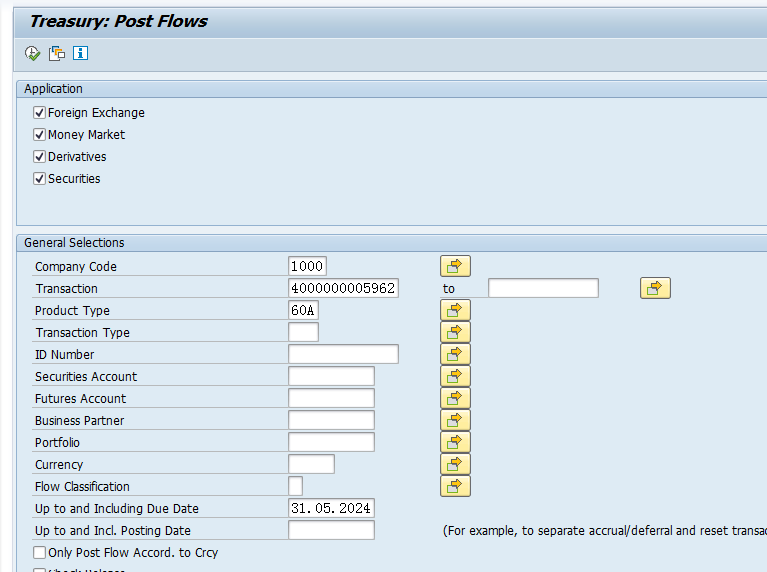

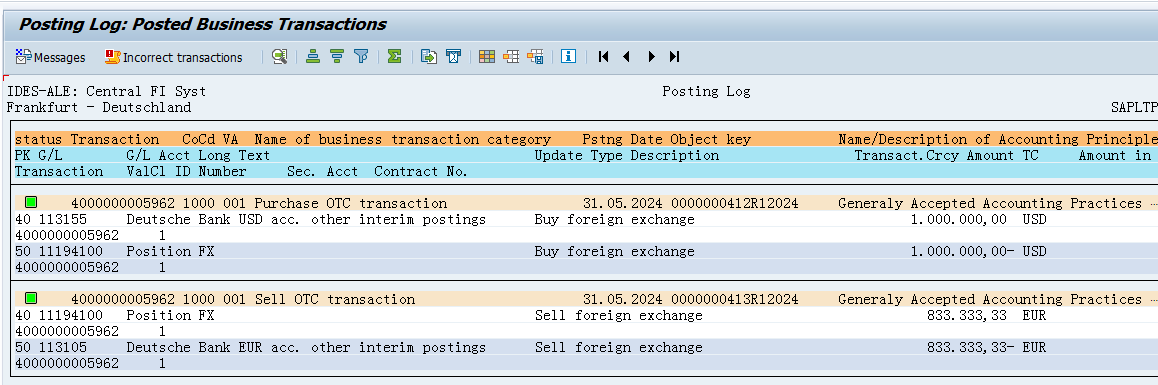

Posting FX forward Deal on maturity

Transaction Code: TBB1

Functionality

This function allows us to create postings, based on the previously entered transactions.

We can carry out a Test run to check the accuracy of the posting specifications in the posting log. When the posting run takes place, the transfer of the flows and posting information to FI takes place. The relevant FI documents are generated.

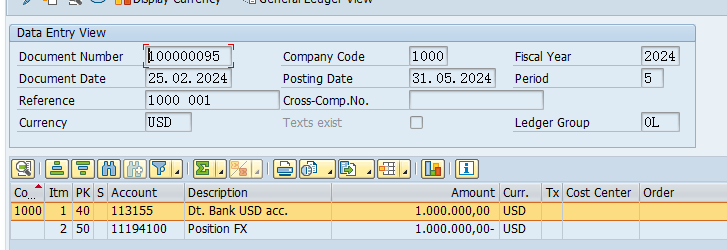

Buy USD Accounting Document

We received 1 million USD in bank account as below

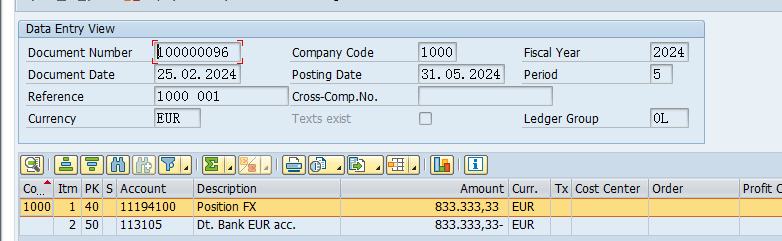

Sell 833,333 EUR accounting document.

EUR 833,333 went out of bank account as shown below

For detailed step by step instructions on configuration and end user training in SAP Treasury follow my course below SAP Treasury and Risk Management