Table of Contents

General Settings

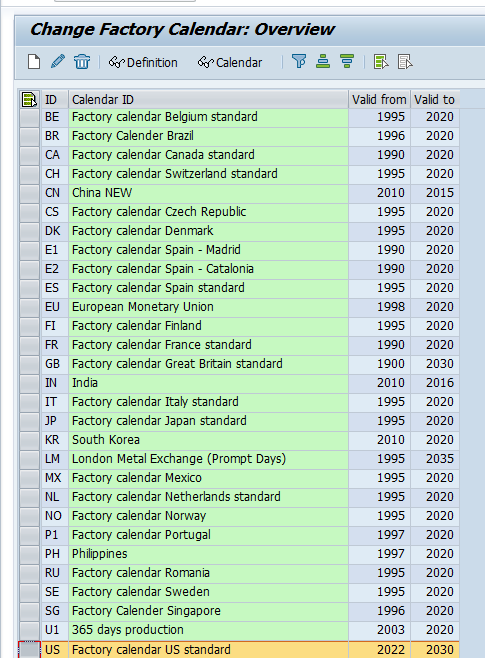

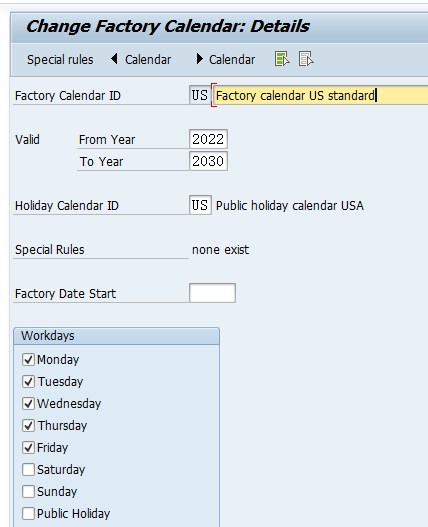

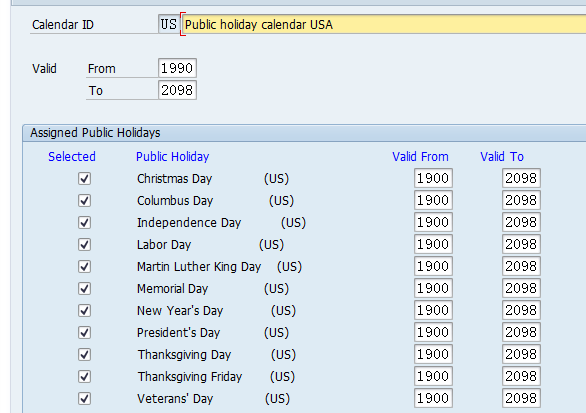

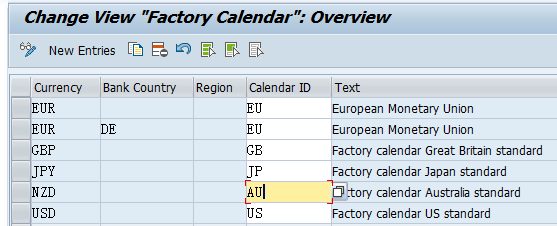

Maintain Calendar

IMG: SAP Netweaver – General Settings – Maintain Calendar

The Factory Calendar is relevant for the Treasury. Ensure Factory calendar is maintained for current year.

Click change and ensure Factory Calendar is valid for current year

Assign Holiday calendar to factory calendar. Verify assigned holiday calendar has the correct holidays

Basic Functions

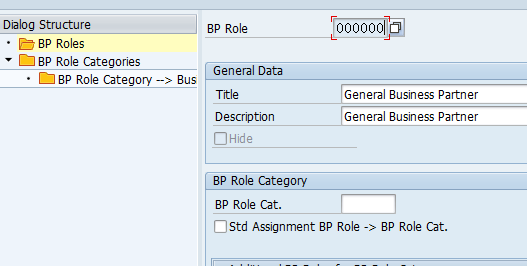

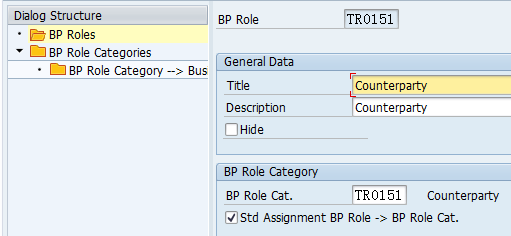

Define BP Roles

IMG : FSCM – Basic Functions – SAP BP for Financial Services – General Settings – Business Partner – Basic Settings – Business Partner Roles – Define BP Roles

SAP has pre delivered the required BP roles. In Treasury below BP roles are used

- General : 000000

- Counterparty : TR0151

- Issuer : TR0150

- Depository Bank for Securities : TR0153

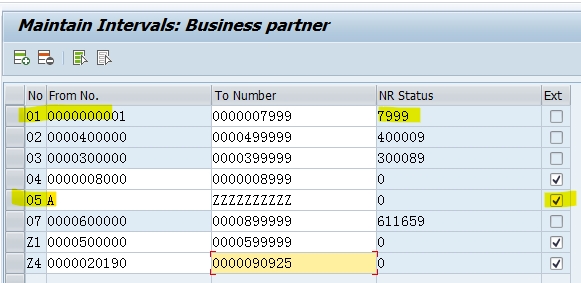

Define Number Ranges

IMG : FSCM – Basic Functions – SAP BP for Financial Services – General Settings – Business Partner – Basic Settings- Number Range and Groupings

Define Business Partner number ranges. Assign Number ranges to groupings

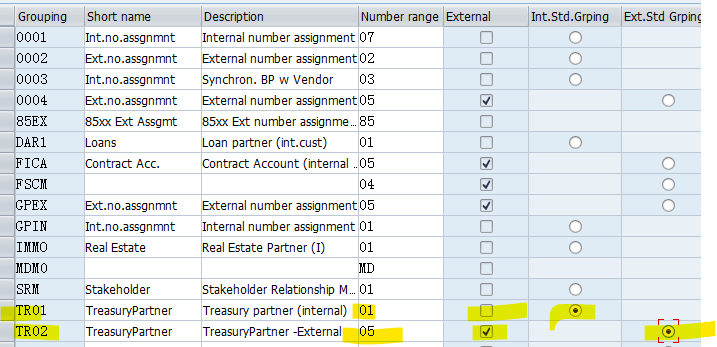

Define Grouping and Assign Number Ranges

IMG : FSCM – Basic Functions – SAP BP for Financial Services – General Settings – Business Partner – Basic Settings- Number Range and Groupings

- Grouping TR01 : Internal Number Range

- Grouping TR02 : External Number Range

Select TR01 as Internal standard grouping and TR02 as external standard grouping

Market Data Management

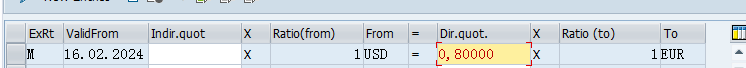

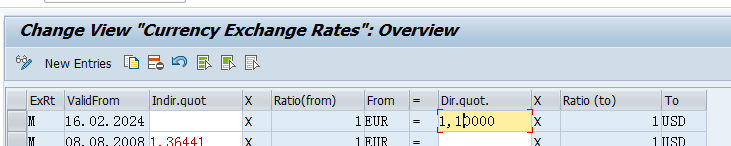

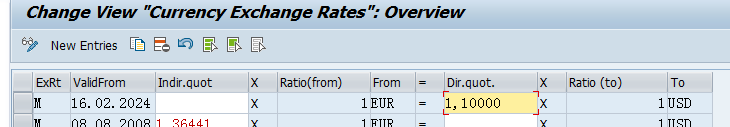

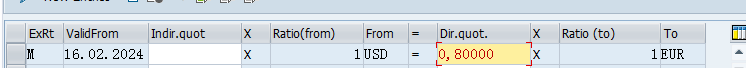

Check Exchange Ratio for Currency Translation

FSCM – Treasury & Risk Management – Basic Functions – Market Data Management – Master Data – Currencies – Check Exchange Ratio for Currency Translation

Enter currency Exchange Ratio

It is entered for each exchange rate type and currency pair

Where an alternate Exchange Rate type is entered for a currency pair, system will use that

We will use the System delivered ratios

For USD to EUR when Exchange Rate type is ‘M’ system will still use EURX exchange ratio. We will delete Alt exchange rate so that system used Exchange Rate type ‘M’ for USD to EUR conversion

Define Leading Currency

IMG: TRM – Transaction Manager – Currencies – Define Leading Currency

Explanation: The exchange rate expresses the amount in the following currency for one unit of the leading currency.

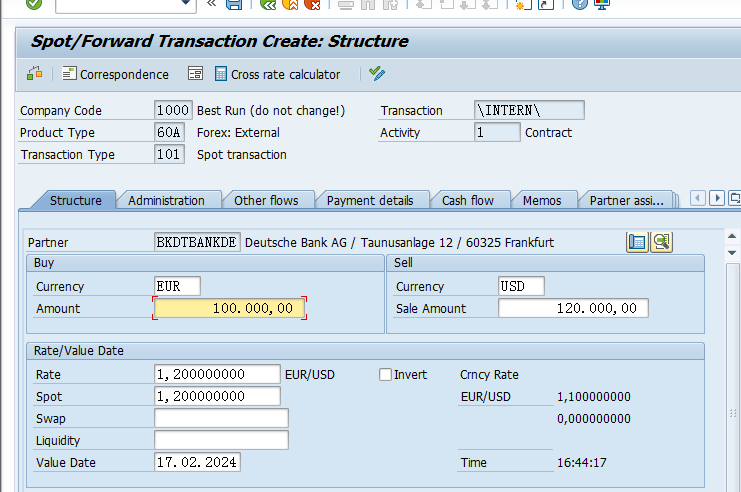

Now create an FX spot transaction. Spot rate for EUR to USD here will be based on leading currency. As leading currency is EUR rate is 1 EUR = following currency (USD)

Spot Rate entered is 1,2 (1 EUR = 1,2 usd). System rate comes correctly as 1,1 (1 EUR = 1,1 USD)

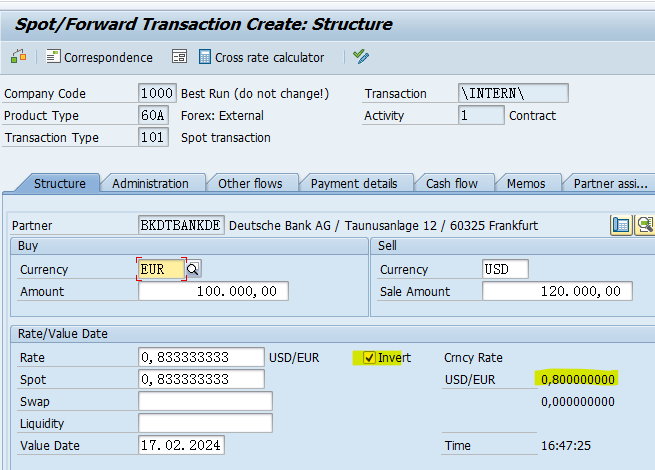

If we select check box “Invert” system rate is displayed as 1 USD = EUR (leading currency). It comes as .8 correctly as below.

OB08

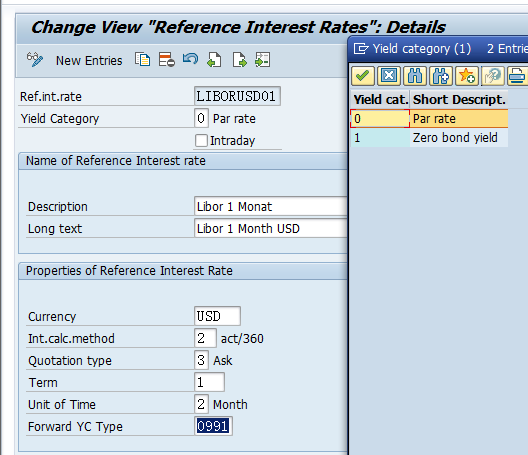

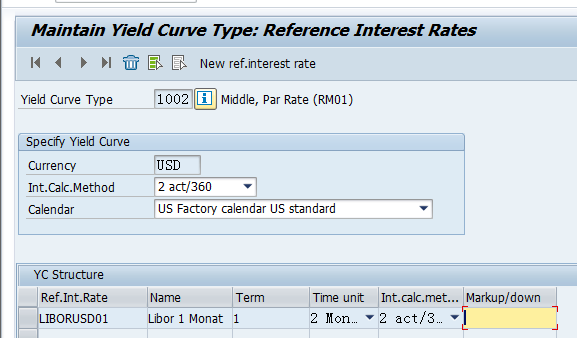

Define Reference Interest Rates

FSCM – Treasury & Risk Management – Basic Functions – Market Data Management – Master Data- Settings for Ref Interest Rates & Yield Curves for Analyzers – Define Reference Interest Rates

Reference Interest Rates: These are benchmark rates used in financial markets to set the interest rates for financial instruments like loans, mortgages, bonds. E.g. LIBOR (London Interbank Offered Rate), EURIBOR ( European Interbank offered Rate)

Reference Interest Rate: LIBORUSD01

Yield Category

- Par Rate: Interest paid during life of bond.

- Zero Bond: Purchase price is the discounted Face value. No interest paid during life of bond.

Currency: USD

Interest Calculation Method: Actual / 360

Term: 1 month. This implies this reference rate is for a period with a remaining maturity of 1 month.

Forward Yield Curve Type is: 0991.

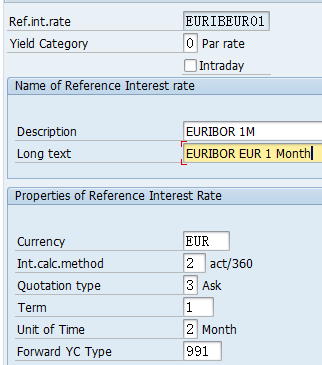

Reference Interest Rate: EURIBOR

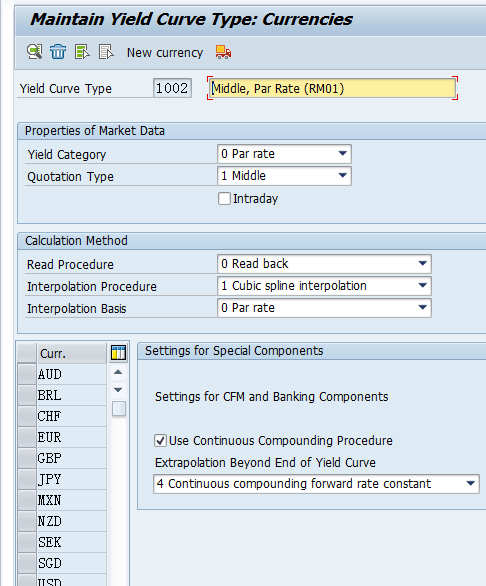

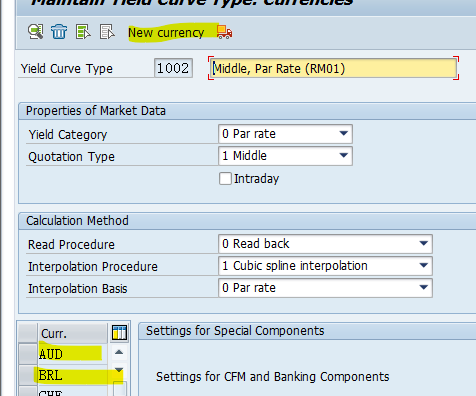

Define Yield Curve Type

FSCM – Treasury & Risk Management – Basic Functions – Market Data Management – Master Data- Settings for Ref Interest Rates & Yield Curves for Analyzers- Define Yield Curve Types

Yield curve Types are defined using below values:

- Yield Category

- Quotation Type

- Interest Calculation Method

- Interpolation Procedure

- Read Procedure

- Currencies – As many as necessary

These yield curves are than assigned to Reference interest rates defined in last step.

Yield Curve

- Graph which shows how interest rates on bond change based on its remaining time to maturity.

Yield Category

- Par Rate: Interest bond which pays fix interest / coupon rate during its lifetime.

- Zero bond yield

- Issues at discount to their face value (Par Value). Do not pay interest during their lifetime.

Quotation Type: Average / Middle Rate. Average of Buy/ Sell Rate

Calculation Method

- Read Back: Most recent value of interest rate used for interpolation.

Extrapolation Beyond End of Yield Curve

- Continuous compounding, forward rate is constant.

Assign Currencies to Yield curve Type.

Click New currency and add the currencies to be assigned to Yield curve

Assign Reference Interest Rate to the currency.

Transaction Manager

General Settings

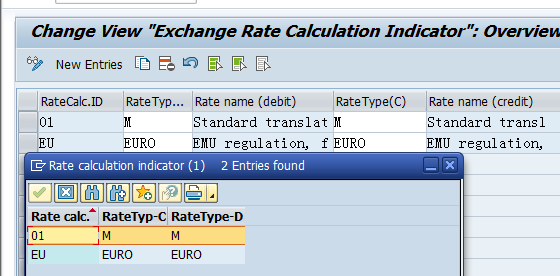

Define Calculation Indicator

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings – Organization

Specify the Calculation Indicator, which is linked to Exchange Rate type used for exchange rates calculation.

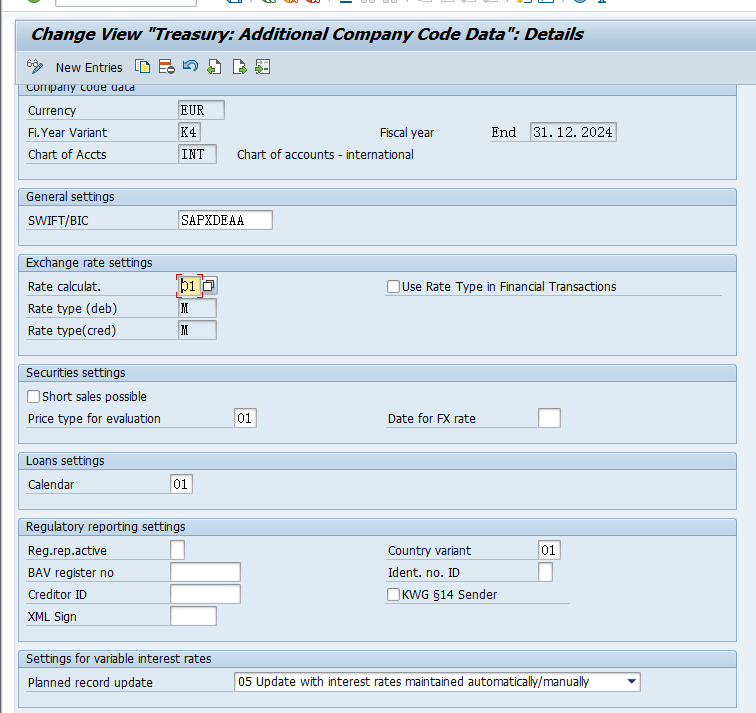

Define Company Code Additional Data

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings – Organization

Assign

- SWIFT Code

- Exchange Rate Type / Rate Calculation Method

- Variable Interest Rate calculation and its update to treasury transactions.

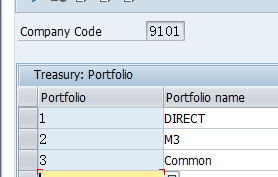

Define Portfolio

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings – Organization

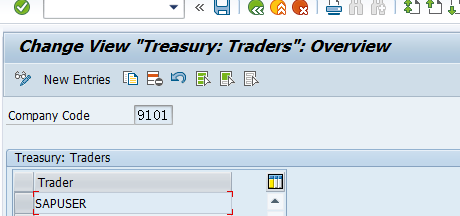

Define Traders

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings – Organization

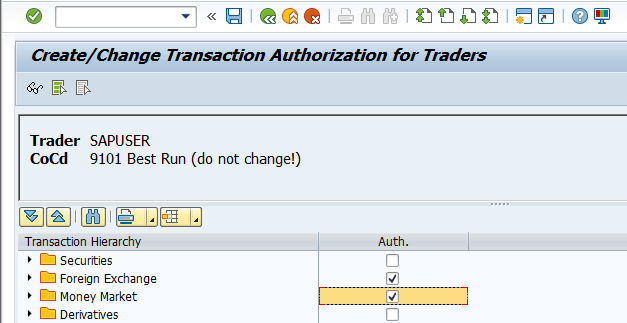

Authorize the Traders for Trade Types

Transaction Code: TBT1

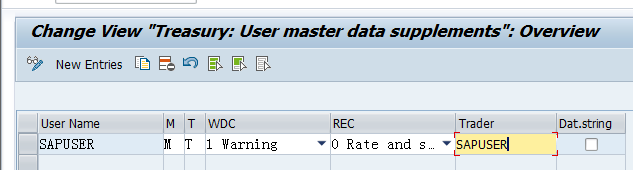

Define User Data

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings – Organization

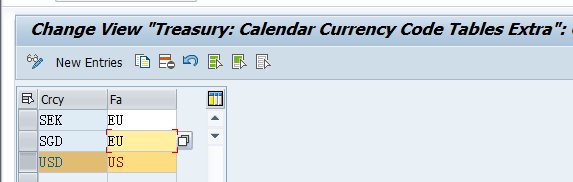

Assign Calendar

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings- Transaction Management – Currencies

Assign Factory Calendar to currencies. System performs a working day check based on this calendar for each currency at time of creation of treasury transactions (FTR_Create)

Payment Management

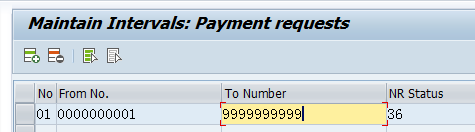

Define Number Range for Payment Request

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Payment Management- Payment Request

Define Number Range for Payment Request

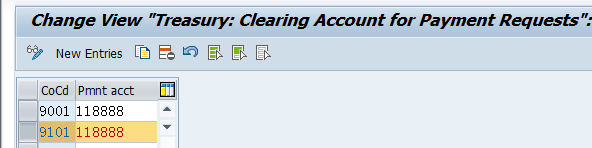

Define Clearing Account for Payment Request

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Payment Management- Payment Request

Define the GL account to which posting is made when Payment request is created. E.g.: Fix Term deposit treasury transaction created in Tcode FTR_CREATE. It is than posting in Tcode TBB1. Here Payment request is created. This is Posted to GL Account defined in this configuration.

Assign Factory Calendar to Payment Currencies

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Payment Management- Payment Handling- Value Date

Accounting

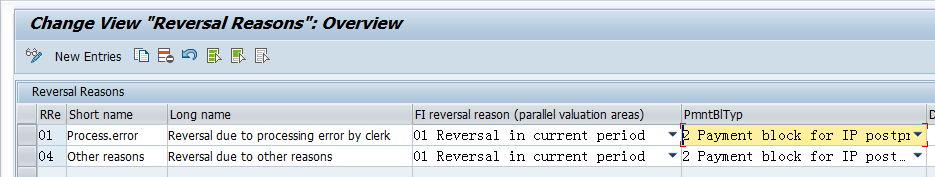

Define Reasons for Reversals

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting – Define Reasons for Reversals

Enter these reasons while reversing in treasury.

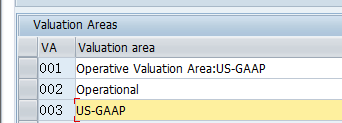

Define Valuation Areas

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Organization

- Operative Val Area is mandatory.

- The other two valuation areas are parallel valuation areas. These are optional.

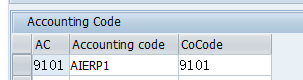

Define Accounting Codes

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Organization

Accounting Code equivalent to FI Company Code. There is one to one relationship between Accounting Code and FI Company Code

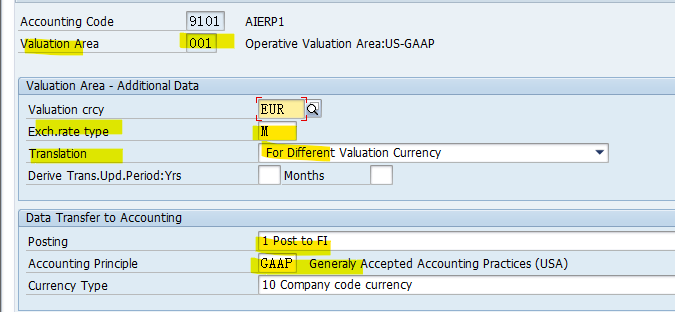

Assign Accounting Code and Valuation Areas

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Organization

- Assign Valuation Areas to the Accounting Code

- Different Valuation Currency: The amount in valuation currency is only translated if the valuation currency is different to the local currency. transferred.

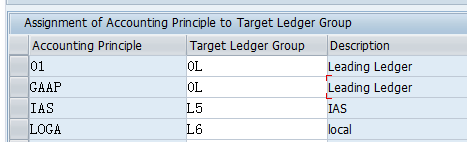

- Accounting Principle is a very important field as it indirectly controls which ledger group the Accounting Code/Valuation Area combination will post to.

Accounting Principal GAAP is assigned to Leading ledger as can be checked below.

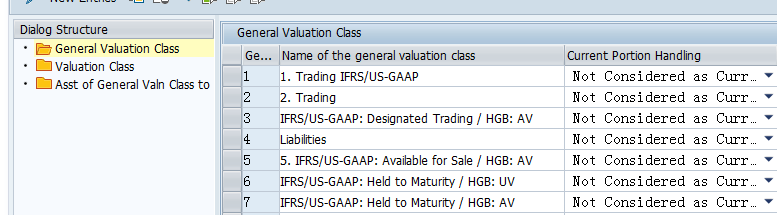

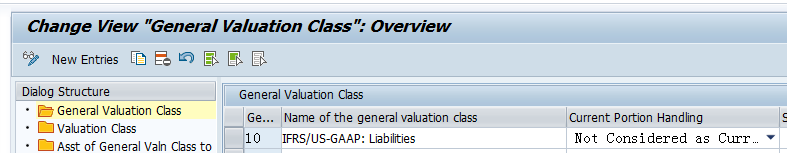

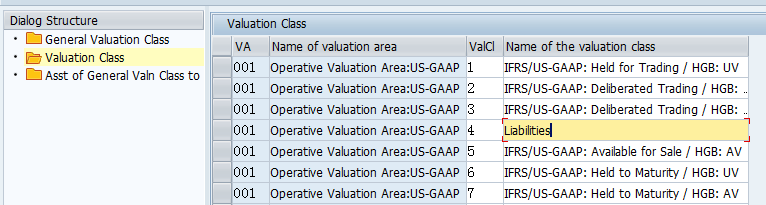

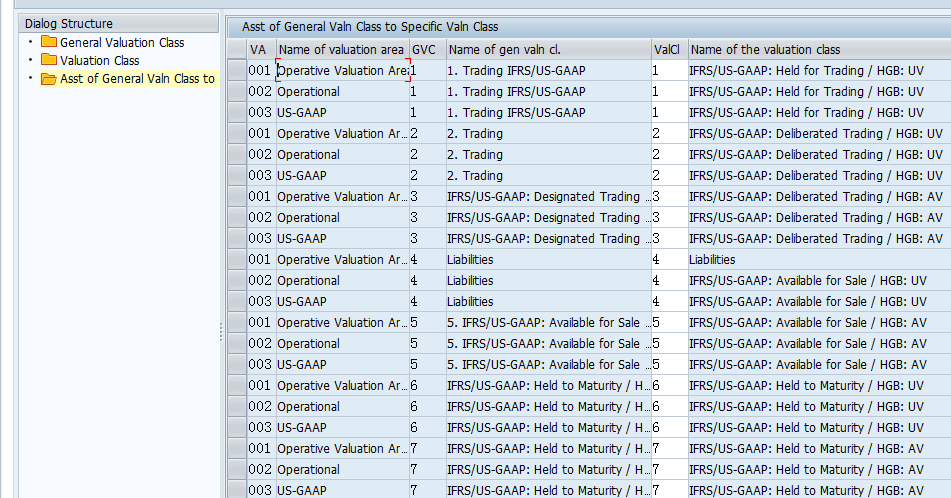

Define and Assign Valuation Classes

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management

- Define General Valuation Class and Special Valuation Class for each Valuation Area

- Assign Special Valuation Class to General Valuation Class

Assignment of Valuation Area to Special Valuation Class

Assignment of General Valuation Class to Special Valuation Class

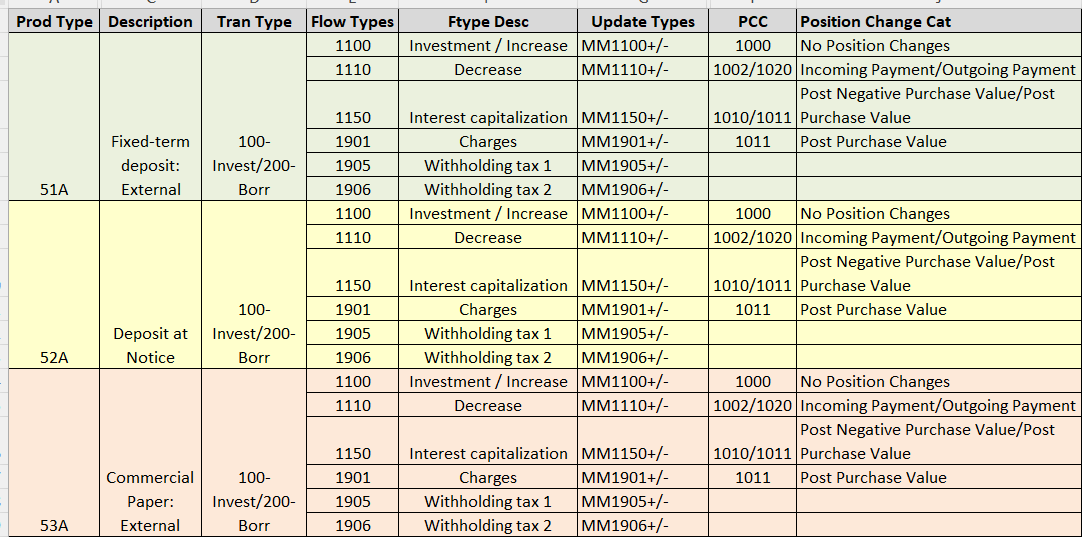

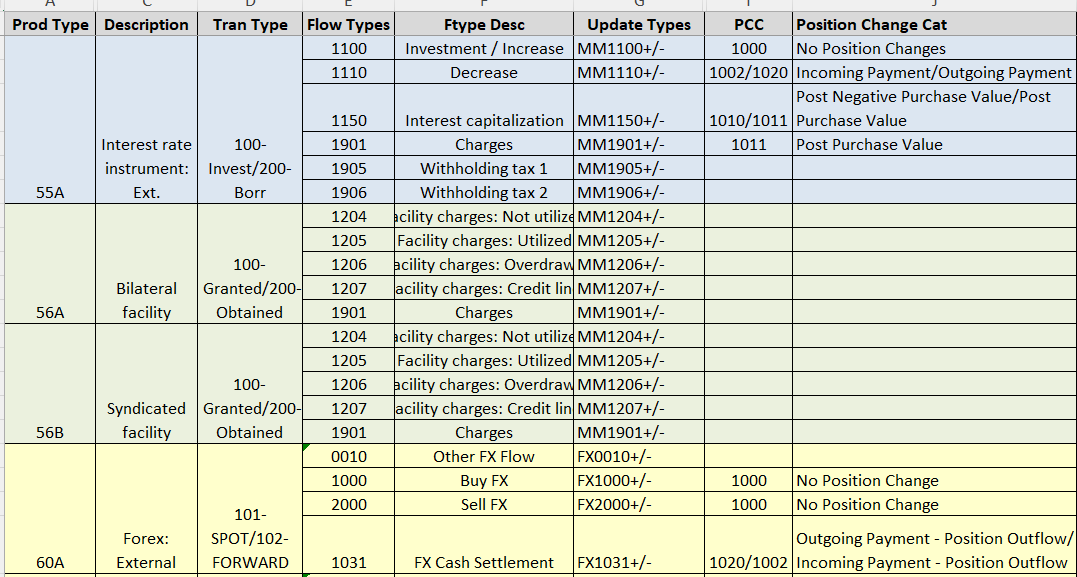

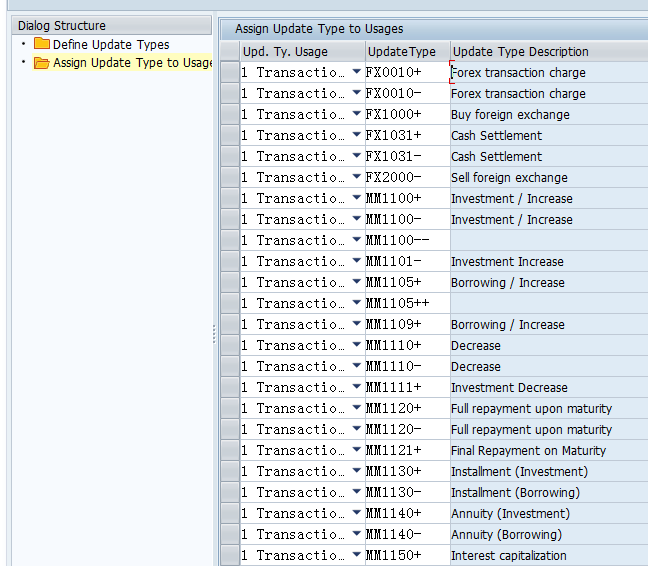

Define Update Type and Assign Usages

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting – Hedge Accounting – Update Types

We will use the below SAP standard Update types for various Treasury products- Interest Rate Instruments, Fix Term deposits, Commercial Papers, Facilities, FX Spot Transactions, FX Forward Transaction

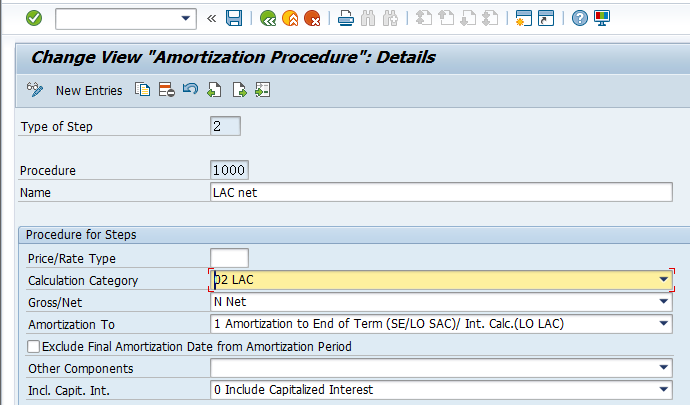

Define Amortization Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management – Key Date Valuation

Amortization is distribution of Profit / Loss on treasury instruments over its life term.

We will use Standard Amortization Procedure: 1000

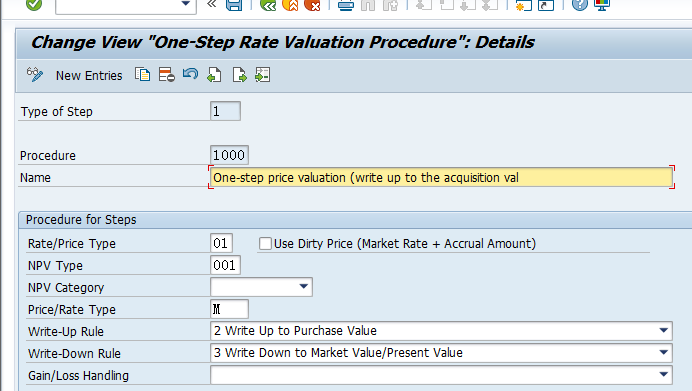

One Step Price Valuation Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management – Key Date Valuation

We will use SAP standard price valuation procedure 1000 as detailed below.

- Procedure: 1000

- Rate: 01-Spot Rate

- NPV Type: 001- Continuous Valuation

- Exchange Rate Type: M

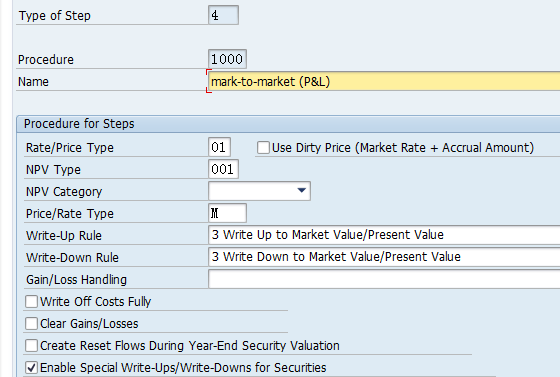

Define Security Valuation Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management – Key Date Valuation

We will use SAP standard price valuation procedure 1000 as detailed below.

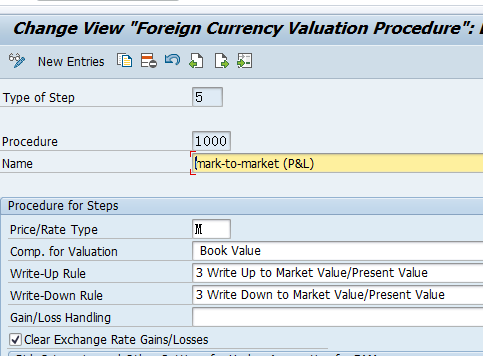

Define Foreign Currency Valuation Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management – Key Date Valuation

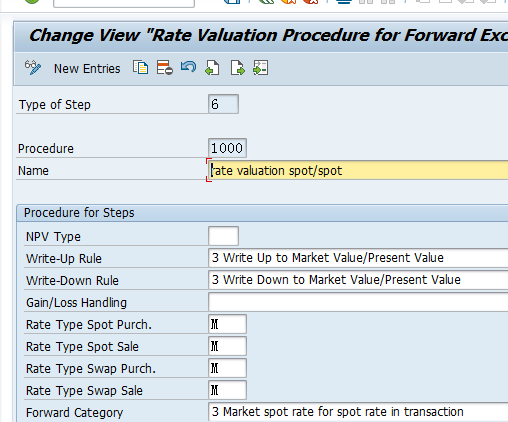

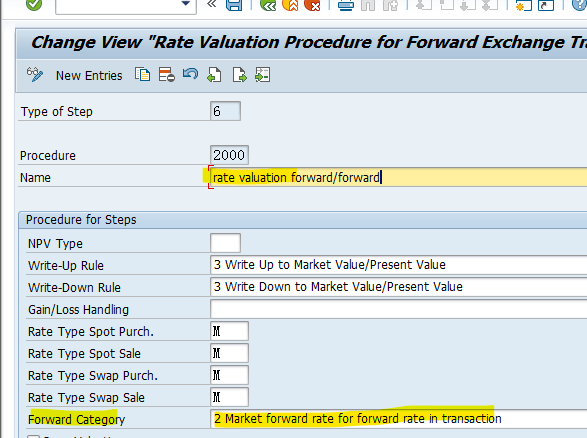

Define Price Valuation Procedure for Forward Exchange Transactions

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management – Key Date Valuation

We will use SAP standard price valuation procedure 1000 as detailed below.

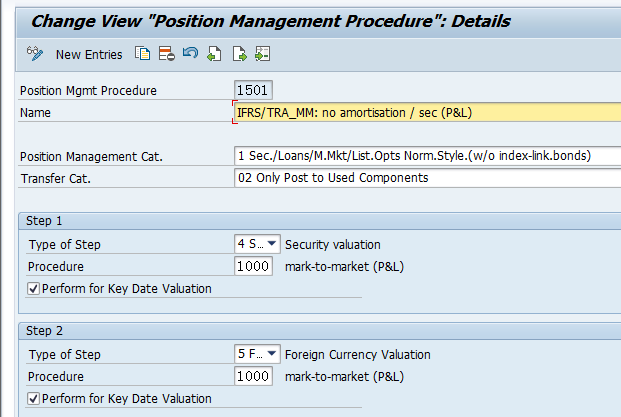

Define Position Management Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management

The PMP impacts the key date valuation and derived business transactions. It determines how derived business transactions are generated in case of position outflows or balance sheet transfers.

We will use SAP standard PMP as detailed below.

| Product Type | Description | Procedure | Position Mngt Procedure | |

| 51A | Fix Term Deposit | Security Valuation Foreign Currency Valuation | 1000 1000 | 1501 |

| 52A | Deposit Notice | Security Valuation Foreign Currency Valuation | 1000 1000 | 1501 |

| 53A | Commercial Paper | Security Valuation Foreign Currency Valuation | 1000 1000 | 1501 |

| 55A | Interest Rate Instruments | Foreign Currency Valuation | 1000 | MM |

| 60A | FX Spot / Forward | Forward Rate Valuation Security Valuation | 1000 1000 | 1401 |

| 60N | FX Non-Deliverable Forward | Forward Rate Valuation Security Valuation | 1000 1000 | 1401 |

| 56A | Facility | No Valuation | NA | 1520 |

Assign Position Management Procedure

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Settings for Position Management

Position Management Procedure assigned to Product Category as shown below

| Prod Type | Prod Cat | Description | PMP | |

| 51A | 510 | Fixed-term deposit: External | 1501 | |

| 52A | 520 | Deposit at Notice | 1501 | |

| 53A | 530 | Commercial Paper: External | 1501 | |

| 55A | 550 | Interest rate instrument: Ext. | MM | |

| 56A | 560 | Bilateral facility | 1520 | |

| 60A | 600 | Forex: External | 1401 | |

| 60N | 600 | Non-Deliverable Forward | 1401 | |

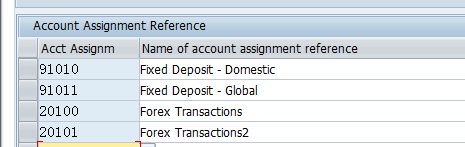

Define Account Assignment References

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Link to Other Accounting Components

They make the link between a conceptual GL account called “account symbol” and a specific GL account in chart of account.

Define Account Assignment Reference Determination

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Link to Other Accounting Components

This activity maps the transactions to an account assignment reference through derivation rules. This customization happens in 2 steps. First you define a template for the rule; the template defines source fields (input) and Target Fields (output). The second step is to maintain the mapping values.

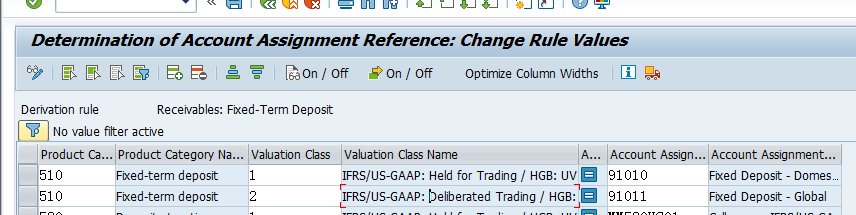

Update the determination rule for Fix Term Deposit for Valuation Class 1 & 2 as below.

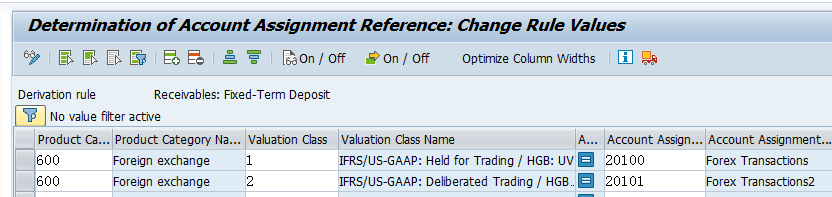

Below Update for FX Deals

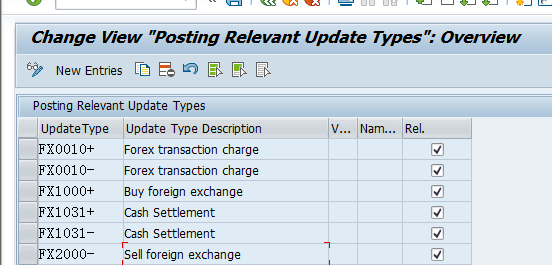

Indicate Update Type as Relevant to Posting

IMG- FSCM – Treasury & Risk Management- Transaction manager – General Settings-Accounting- Link to Other Accounting Components

Specify whether an update type will post FI document or not

We will use the SAP standard update types.

We will continue with remaining TRM configurations steps including GL account assignment to Account Assignment Reference, Credit Risk Analyzer, Product Type (Money Market, Forex etc.) in SAP_TRM Part 2